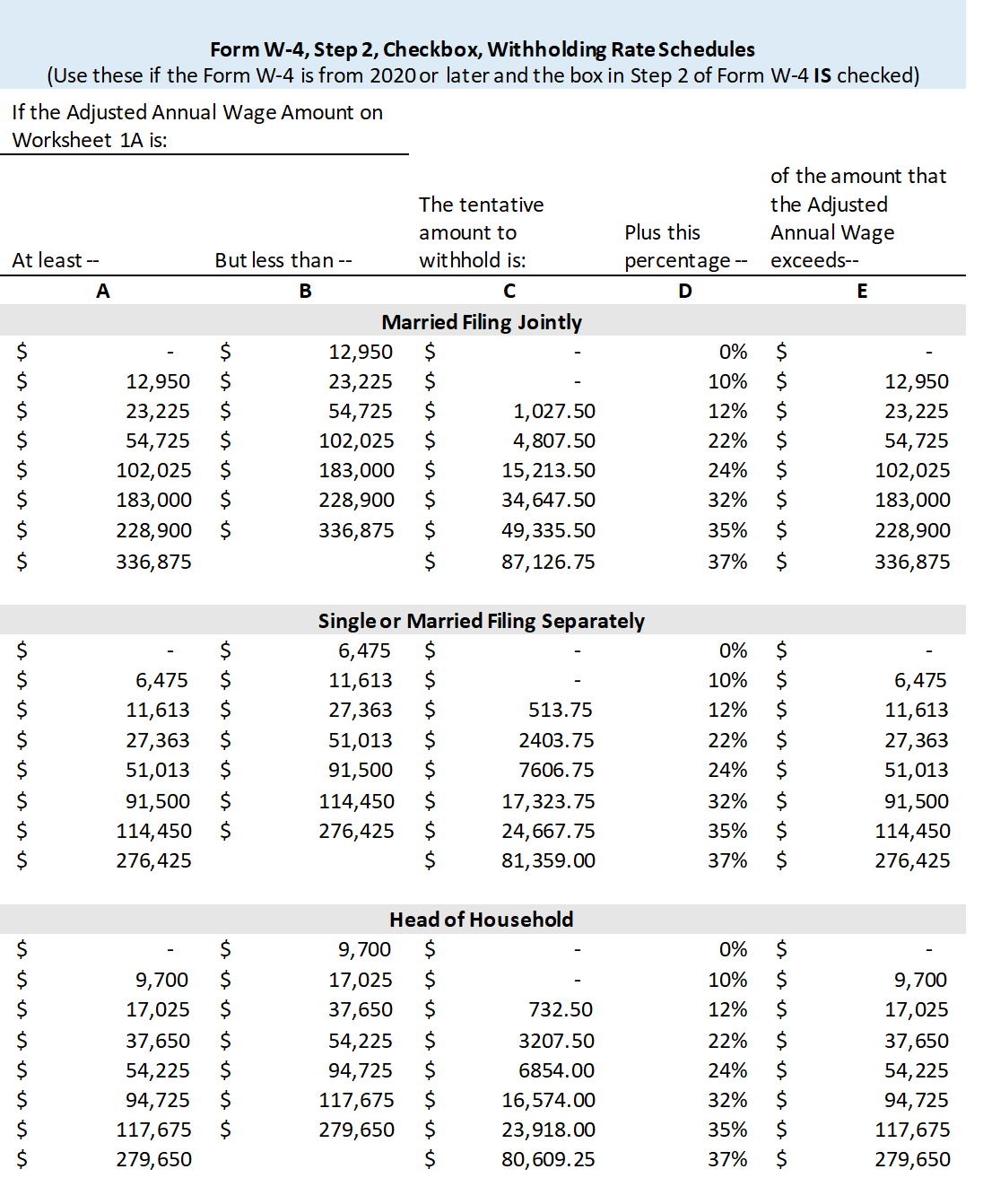

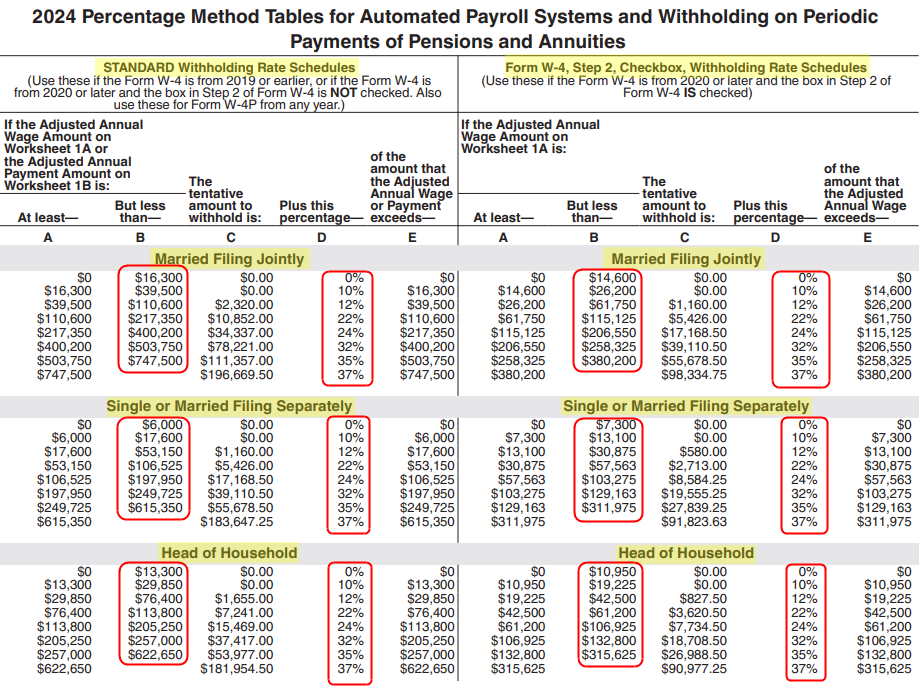

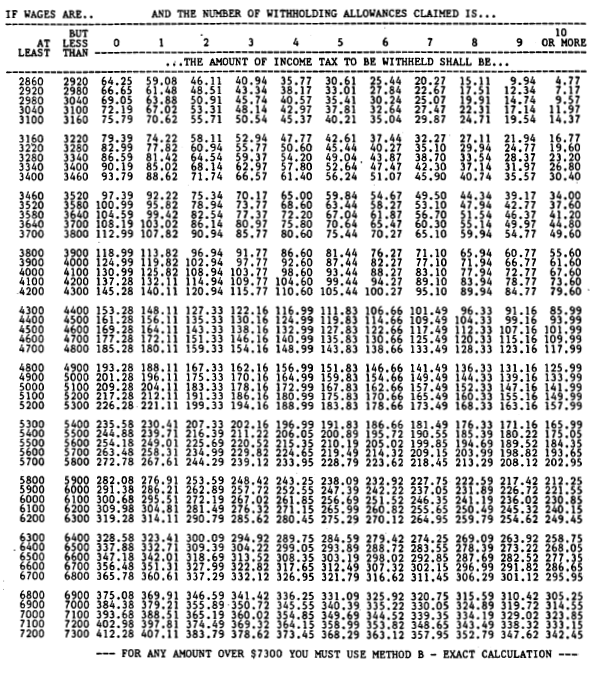

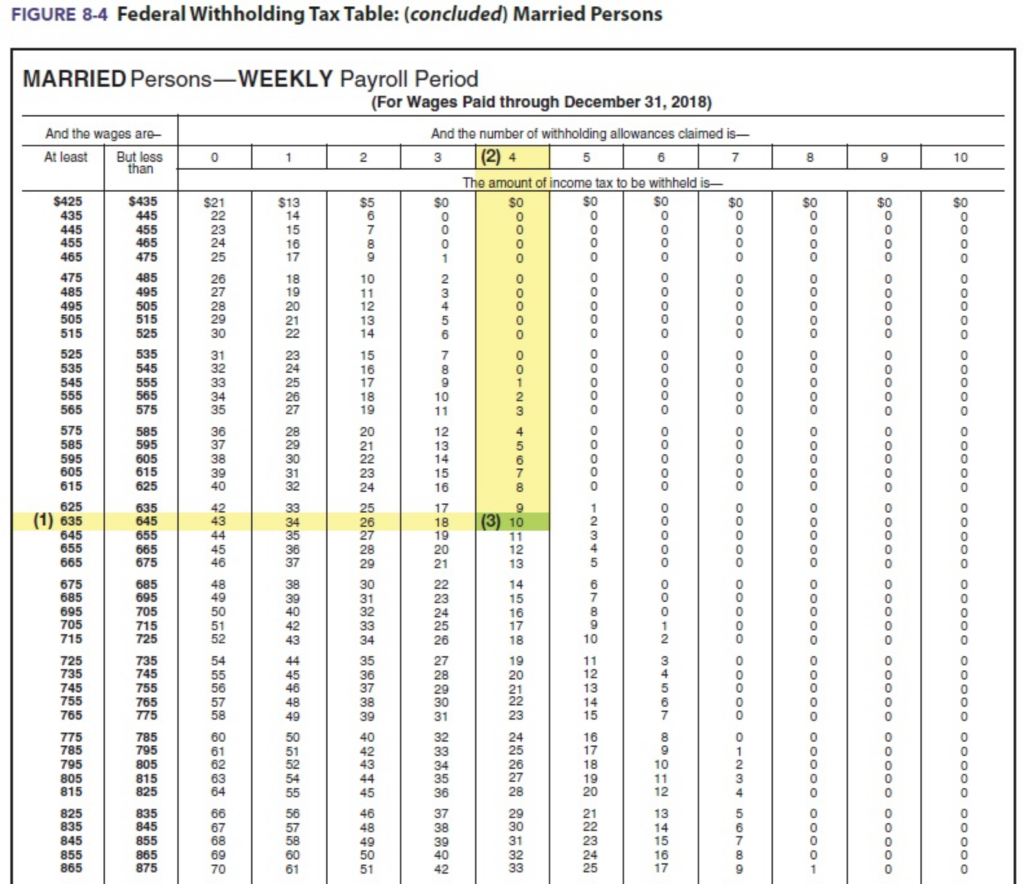

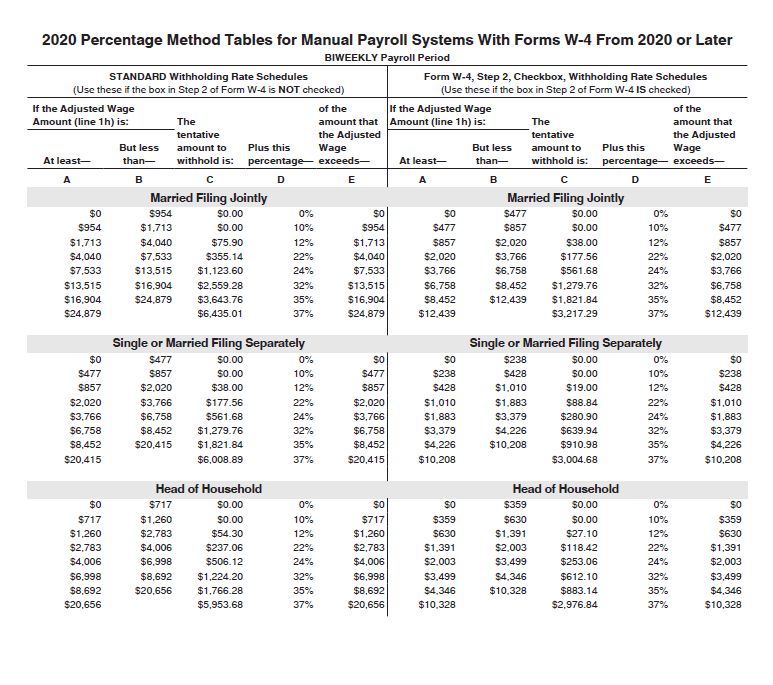

Withholding Tax Table - We produce a range of tax tables to help you work out how much to withhold from payments you. Update your payroll tax rates with these useful tables from irs publication 15,. In lieu of worksheet 1b and the percentage method tables in section 1, you may use. If you're a payer making periodic payments of pensions and annuities, use worksheet 1b and. Compute withholding tax amounts for salaries, services, and other income types in the.

Update your payroll tax rates with these useful tables from irs publication 15,. We produce a range of tax tables to help you work out how much to withhold from payments you. In lieu of worksheet 1b and the percentage method tables in section 1, you may use. If you're a payer making periodic payments of pensions and annuities, use worksheet 1b and. Compute withholding tax amounts for salaries, services, and other income types in the.

Compute withholding tax amounts for salaries, services, and other income types in the. In lieu of worksheet 1b and the percentage method tables in section 1, you may use. We produce a range of tax tables to help you work out how much to withhold from payments you. Update your payroll tax rates with these useful tables from irs publication 15,. If you're a payer making periodic payments of pensions and annuities, use worksheet 1b and.

Federal Withholding Tax Table Matttroy

In lieu of worksheet 1b and the percentage method tables in section 1, you may use. We produce a range of tax tables to help you work out how much to withhold from payments you. Update your payroll tax rates with these useful tables from irs publication 15,. Compute withholding tax amounts for salaries, services, and other income types in.

Withholding Tax Table 2019

In lieu of worksheet 1b and the percentage method tables in section 1, you may use. We produce a range of tax tables to help you work out how much to withhold from payments you. Compute withholding tax amounts for salaries, services, and other income types in the. If you're a payer making periodic payments of pensions and annuities, use.

Federal Withholding Tax Table Matttroy

Update your payroll tax rates with these useful tables from irs publication 15,. Compute withholding tax amounts for salaries, services, and other income types in the. In lieu of worksheet 1b and the percentage method tables in section 1, you may use. If you're a payer making periodic payments of pensions and annuities, use worksheet 1b and. We produce a.

Federal Withholding Tax Table Matttroy

Compute withholding tax amounts for salaries, services, and other income types in the. We produce a range of tax tables to help you work out how much to withhold from payments you. Update your payroll tax rates with these useful tables from irs publication 15,. In lieu of worksheet 1b and the percentage method tables in section 1, you may.

Federal Withholding Tax Table Matttroy

Compute withholding tax amounts for salaries, services, and other income types in the. In lieu of worksheet 1b and the percentage method tables in section 1, you may use. If you're a payer making periodic payments of pensions and annuities, use worksheet 1b and. We produce a range of tax tables to help you work out how much to withhold.

Federal Withholding Tax Table Matttroy

In lieu of worksheet 1b and the percentage method tables in section 1, you may use. We produce a range of tax tables to help you work out how much to withhold from payments you. Update your payroll tax rates with these useful tables from irs publication 15,. If you're a payer making periodic payments of pensions and annuities, use.

Federal Withholding Tax Table Matttroy

Compute withholding tax amounts for salaries, services, and other income types in the. We produce a range of tax tables to help you work out how much to withhold from payments you. In lieu of worksheet 1b and the percentage method tables in section 1, you may use. If you're a payer making periodic payments of pensions and annuities, use.

Federal Withholding Tax Table Matttroy

In lieu of worksheet 1b and the percentage method tables in section 1, you may use. Compute withholding tax amounts for salaries, services, and other income types in the. If you're a payer making periodic payments of pensions and annuities, use worksheet 1b and. We produce a range of tax tables to help you work out how much to withhold.

Bir Annual Withholding Tax Table 2017 Matttroy

Update your payroll tax rates with these useful tables from irs publication 15,. In lieu of worksheet 1b and the percentage method tables in section 1, you may use. We produce a range of tax tables to help you work out how much to withhold from payments you. Compute withholding tax amounts for salaries, services, and other income types in.

2021 Withholding Tax Table Texas Federal Withholding Tables 2021

Compute withholding tax amounts for salaries, services, and other income types in the. If you're a payer making periodic payments of pensions and annuities, use worksheet 1b and. We produce a range of tax tables to help you work out how much to withhold from payments you. Update your payroll tax rates with these useful tables from irs publication 15,..

Compute Withholding Tax Amounts For Salaries, Services, And Other Income Types In The.

Update your payroll tax rates with these useful tables from irs publication 15,. We produce a range of tax tables to help you work out how much to withhold from payments you. If you're a payer making periodic payments of pensions and annuities, use worksheet 1b and. In lieu of worksheet 1b and the percentage method tables in section 1, you may use.