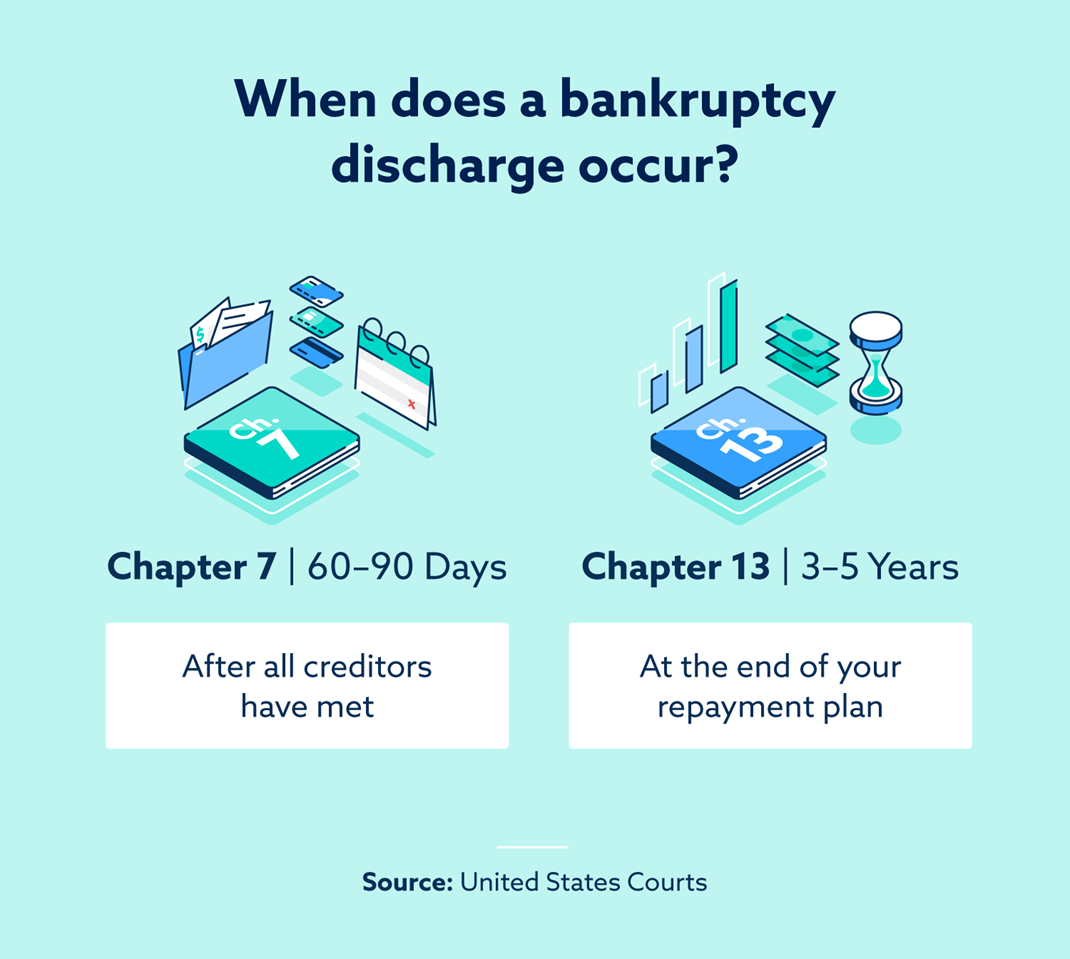

When Are Bankruptcies Discharged - In other words, the debtor is no longer. A bankruptcy discharge is a court order that eliminates qualifying debt in a bankruptcy case, and, for most bankruptcy. A bankruptcy discharge releases the debtor from personal liability for certain specified types of debts. You need to know when your bankruptcy will be discharged to fully understand your financial obligations. Getting a discharge of your debts is a significant step in your bankruptcy, but it is not the end of your case. Your case ends when the court.

You need to know when your bankruptcy will be discharged to fully understand your financial obligations. Your case ends when the court. A bankruptcy discharge is a court order that eliminates qualifying debt in a bankruptcy case, and, for most bankruptcy. A bankruptcy discharge releases the debtor from personal liability for certain specified types of debts. Getting a discharge of your debts is a significant step in your bankruptcy, but it is not the end of your case. In other words, the debtor is no longer.

You need to know when your bankruptcy will be discharged to fully understand your financial obligations. A bankruptcy discharge releases the debtor from personal liability for certain specified types of debts. A bankruptcy discharge is a court order that eliminates qualifying debt in a bankruptcy case, and, for most bankruptcy. Your case ends when the court. Getting a discharge of your debts is a significant step in your bankruptcy, but it is not the end of your case. In other words, the debtor is no longer.

How Does a Bankruptcy Discharge Work? Lexington Law

A bankruptcy discharge releases the debtor from personal liability for certain specified types of debts. You need to know when your bankruptcy will be discharged to fully understand your financial obligations. Your case ends when the court. Getting a discharge of your debts is a significant step in your bankruptcy, but it is not the end of your case. In.

How Does a Bankruptcy Discharge Work? Lexington Law

A bankruptcy discharge is a court order that eliminates qualifying debt in a bankruptcy case, and, for most bankruptcy. You need to know when your bankruptcy will be discharged to fully understand your financial obligations. Your case ends when the court. A bankruptcy discharge releases the debtor from personal liability for certain specified types of debts. In other words, the.

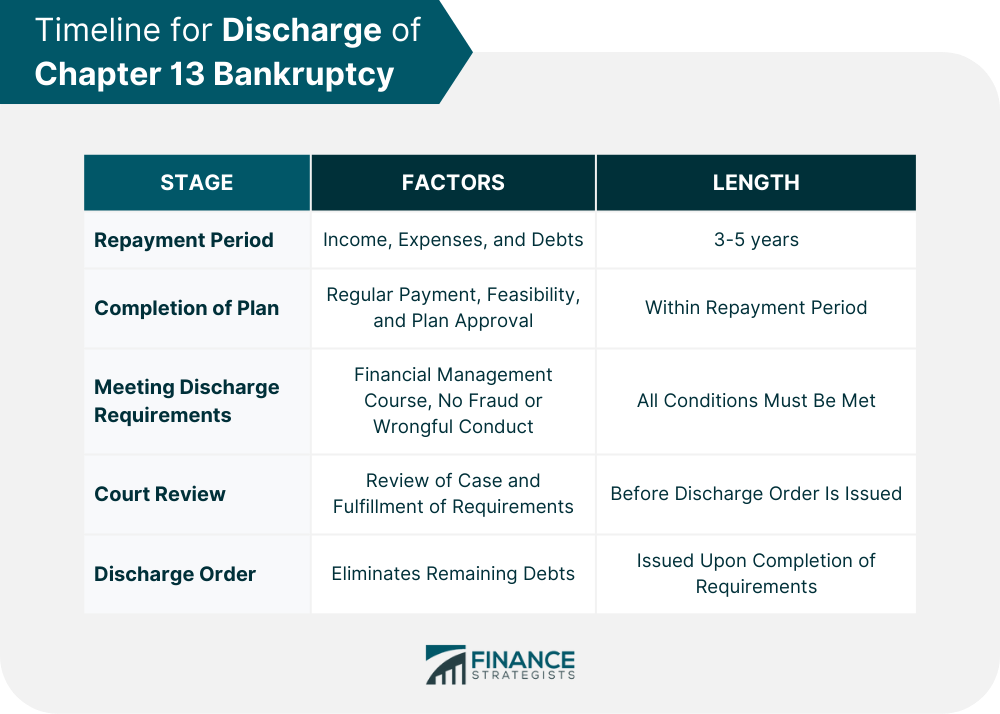

What Happens After a Chapter 13 Discharge? Husker Law

A bankruptcy discharge is a court order that eliminates qualifying debt in a bankruptcy case, and, for most bankruptcy. In other words, the debtor is no longer. You need to know when your bankruptcy will be discharged to fully understand your financial obligations. A bankruptcy discharge releases the debtor from personal liability for certain specified types of debts. Getting a.

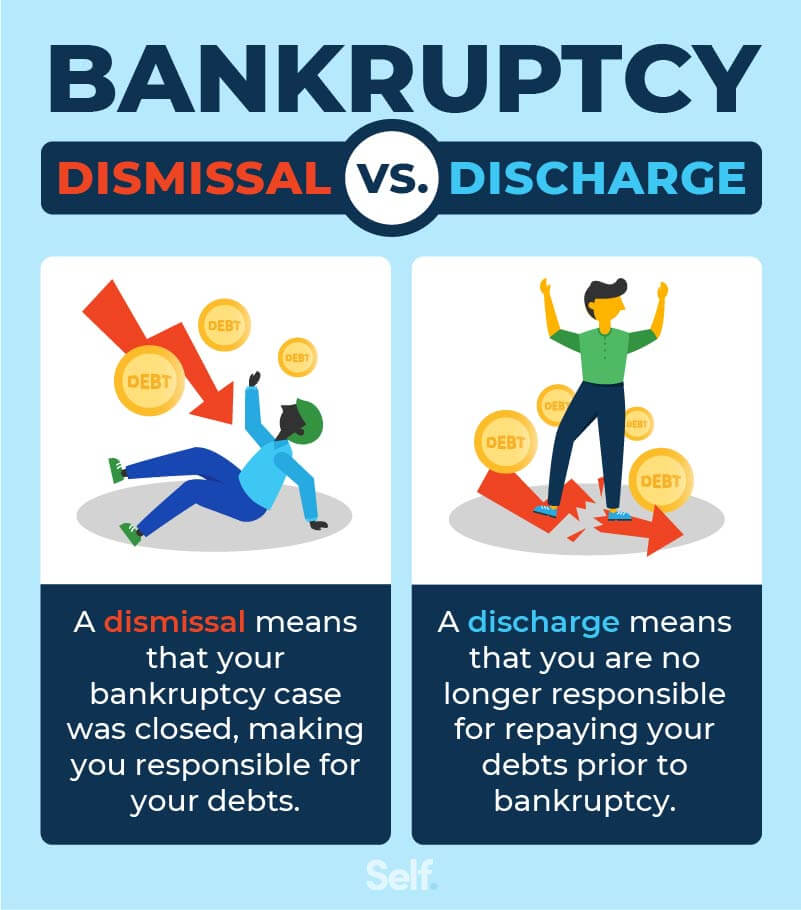

Bankruptcy Dismissal vs. Discharge What's the Difference and How They

A bankruptcy discharge is a court order that eliminates qualifying debt in a bankruptcy case, and, for most bankruptcy. You need to know when your bankruptcy will be discharged to fully understand your financial obligations. In other words, the debtor is no longer. A bankruptcy discharge releases the debtor from personal liability for certain specified types of debts. Getting a.

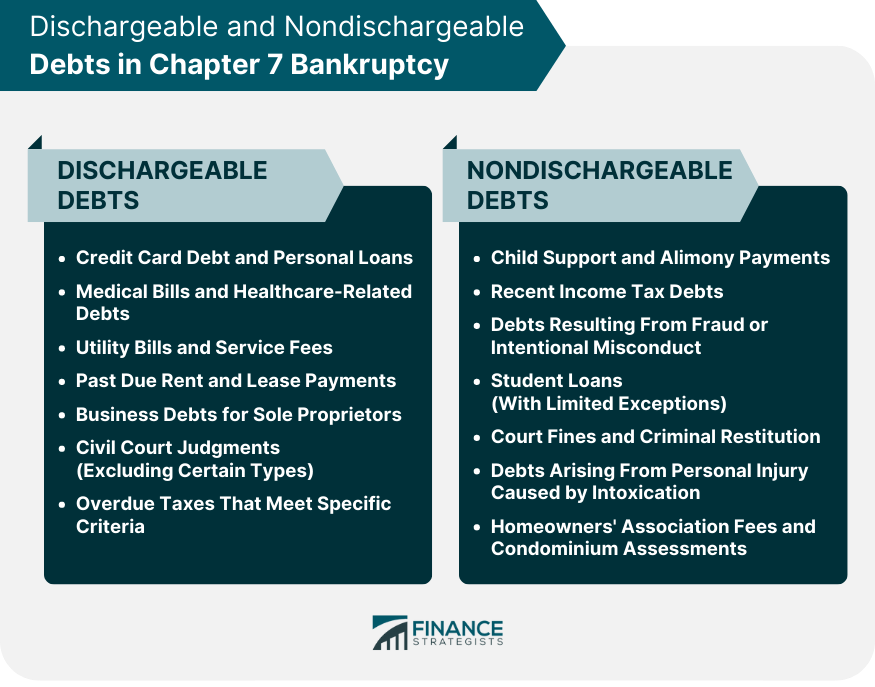

What Debts Are Discharged in Chapter 7 Bankruptcy?

A bankruptcy discharge is a court order that eliminates qualifying debt in a bankruptcy case, and, for most bankruptcy. A bankruptcy discharge releases the debtor from personal liability for certain specified types of debts. You need to know when your bankruptcy will be discharged to fully understand your financial obligations. Your case ends when the court. In other words, the.

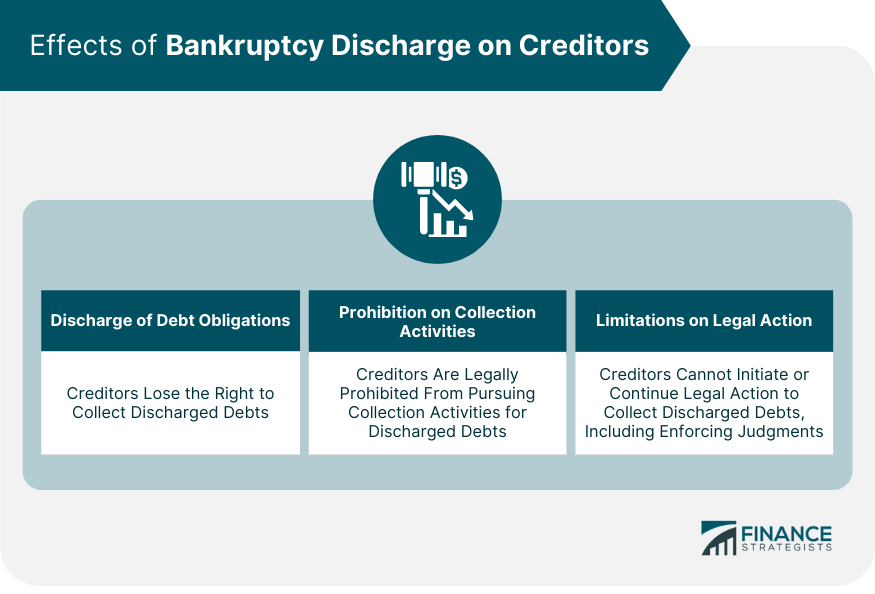

How Bankruptcy Gets Discharged Overview, Impact, Prevention

A bankruptcy discharge is a court order that eliminates qualifying debt in a bankruptcy case, and, for most bankruptcy. In other words, the debtor is no longer. Your case ends when the court. A bankruptcy discharge releases the debtor from personal liability for certain specified types of debts. You need to know when your bankruptcy will be discharged to fully.

What Is a Bankruptcy Discharge?

In other words, the debtor is no longer. Getting a discharge of your debts is a significant step in your bankruptcy, but it is not the end of your case. Your case ends when the court. A bankruptcy discharge is a court order that eliminates qualifying debt in a bankruptcy case, and, for most bankruptcy. A bankruptcy discharge releases the.

What Does Bankruptcy Discharged Mean? Condition & Effects

Your case ends when the court. Getting a discharge of your debts is a significant step in your bankruptcy, but it is not the end of your case. A bankruptcy discharge is a court order that eliminates qualifying debt in a bankruptcy case, and, for most bankruptcy. You need to know when your bankruptcy will be discharged to fully understand.

When Does Chapter 13 Bankruptcy Get Discharged?

A bankruptcy discharge is a court order that eliminates qualifying debt in a bankruptcy case, and, for most bankruptcy. A bankruptcy discharge releases the debtor from personal liability for certain specified types of debts. You need to know when your bankruptcy will be discharged to fully understand your financial obligations. Your case ends when the court. Getting a discharge of.

Bankruptcy Discharge What Is It And Why It's A Vital Step? Debt.ca

In other words, the debtor is no longer. Getting a discharge of your debts is a significant step in your bankruptcy, but it is not the end of your case. A bankruptcy discharge releases the debtor from personal liability for certain specified types of debts. A bankruptcy discharge is a court order that eliminates qualifying debt in a bankruptcy case,.

Getting A Discharge Of Your Debts Is A Significant Step In Your Bankruptcy, But It Is Not The End Of Your Case.

A bankruptcy discharge is a court order that eliminates qualifying debt in a bankruptcy case, and, for most bankruptcy. In other words, the debtor is no longer. You need to know when your bankruptcy will be discharged to fully understand your financial obligations. Your case ends when the court.

:max_bytes(150000):strip_icc()/bankruptcy-discharge-what-is-it-and-when-does-it-happen-8eafb0f711c24a048d4854a82cdb5f70.png)