Oregon Highway Use Tax Bond Form - Regardless of your credit score or financial standing, you can your oregon highway use tax. Highway use tax bond date bond: This bond is executed under ors chapter 825 to assure. Initial bond requests are based on the number of vehicles enrolled or operated in oregon in the. Odot requires motor carriers to post an oregon highway use tax bond for tax collection.

Regardless of your credit score or financial standing, you can your oregon highway use tax. Odot requires motor carriers to post an oregon highway use tax bond for tax collection. Highway use tax bond date bond: This bond is executed under ors chapter 825 to assure. Initial bond requests are based on the number of vehicles enrolled or operated in oregon in the.

Odot requires motor carriers to post an oregon highway use tax bond for tax collection. Highway use tax bond date bond: This bond is executed under ors chapter 825 to assure. Initial bond requests are based on the number of vehicles enrolled or operated in oregon in the. Regardless of your credit score or financial standing, you can your oregon highway use tax.

Download our PDF Sales and Use Tax Bond info sheet

Regardless of your credit score or financial standing, you can your oregon highway use tax. This bond is executed under ors chapter 825 to assure. Highway use tax bond date bond: Initial bond requests are based on the number of vehicles enrolled or operated in oregon in the. Odot requires motor carriers to post an oregon highway use tax bond.

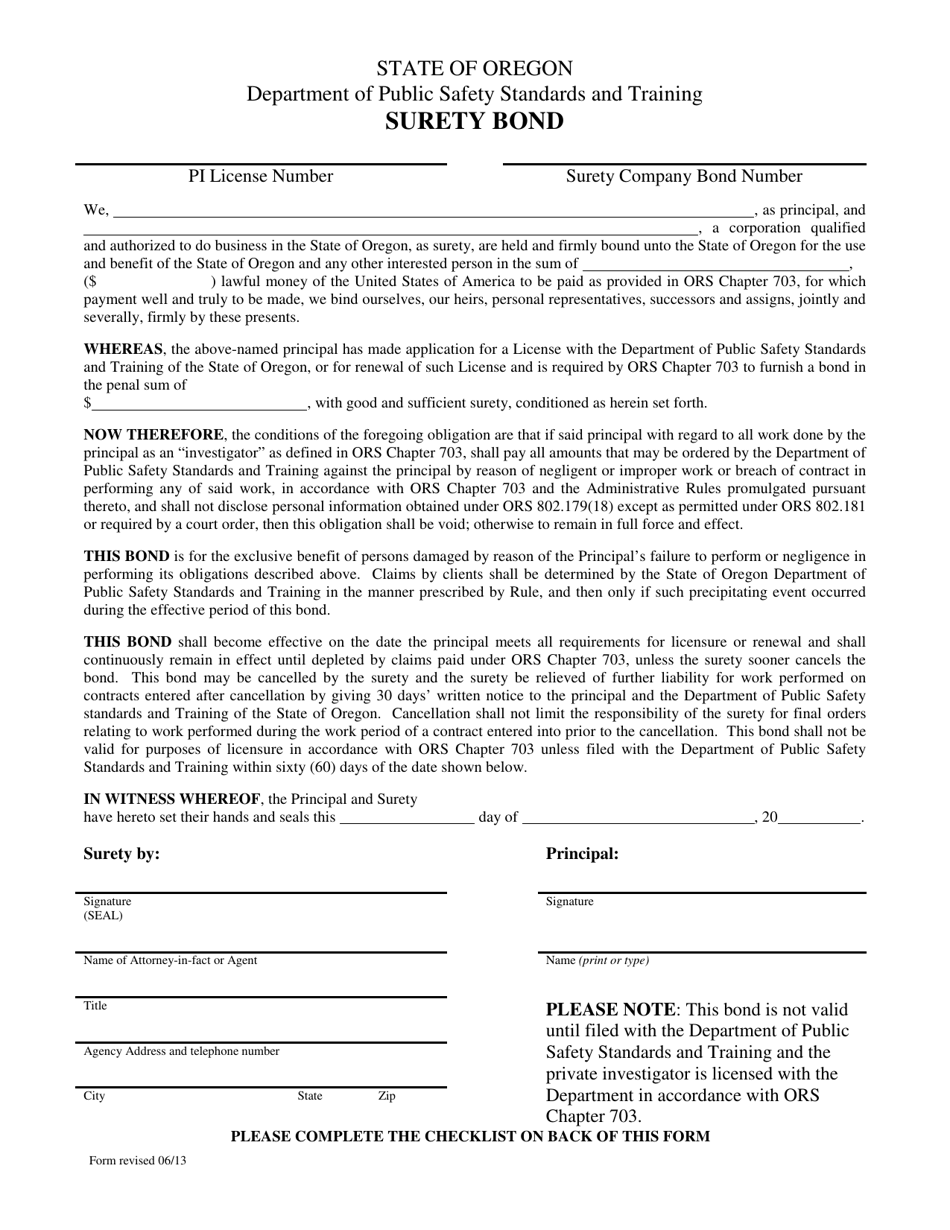

Oregon Surety Bond Form Fill Out, Sign Online and Download PDF

Initial bond requests are based on the number of vehicles enrolled or operated in oregon in the. Regardless of your credit score or financial standing, you can your oregon highway use tax. Highway use tax bond date bond: Odot requires motor carriers to post an oregon highway use tax bond for tax collection. This bond is executed under ors chapter.

Oregon Highway Use Tax Bond Surety Bond Authority

Odot requires motor carriers to post an oregon highway use tax bond for tax collection. This bond is executed under ors chapter 825 to assure. Initial bond requests are based on the number of vehicles enrolled or operated in oregon in the. Regardless of your credit score or financial standing, you can your oregon highway use tax. Highway use tax.

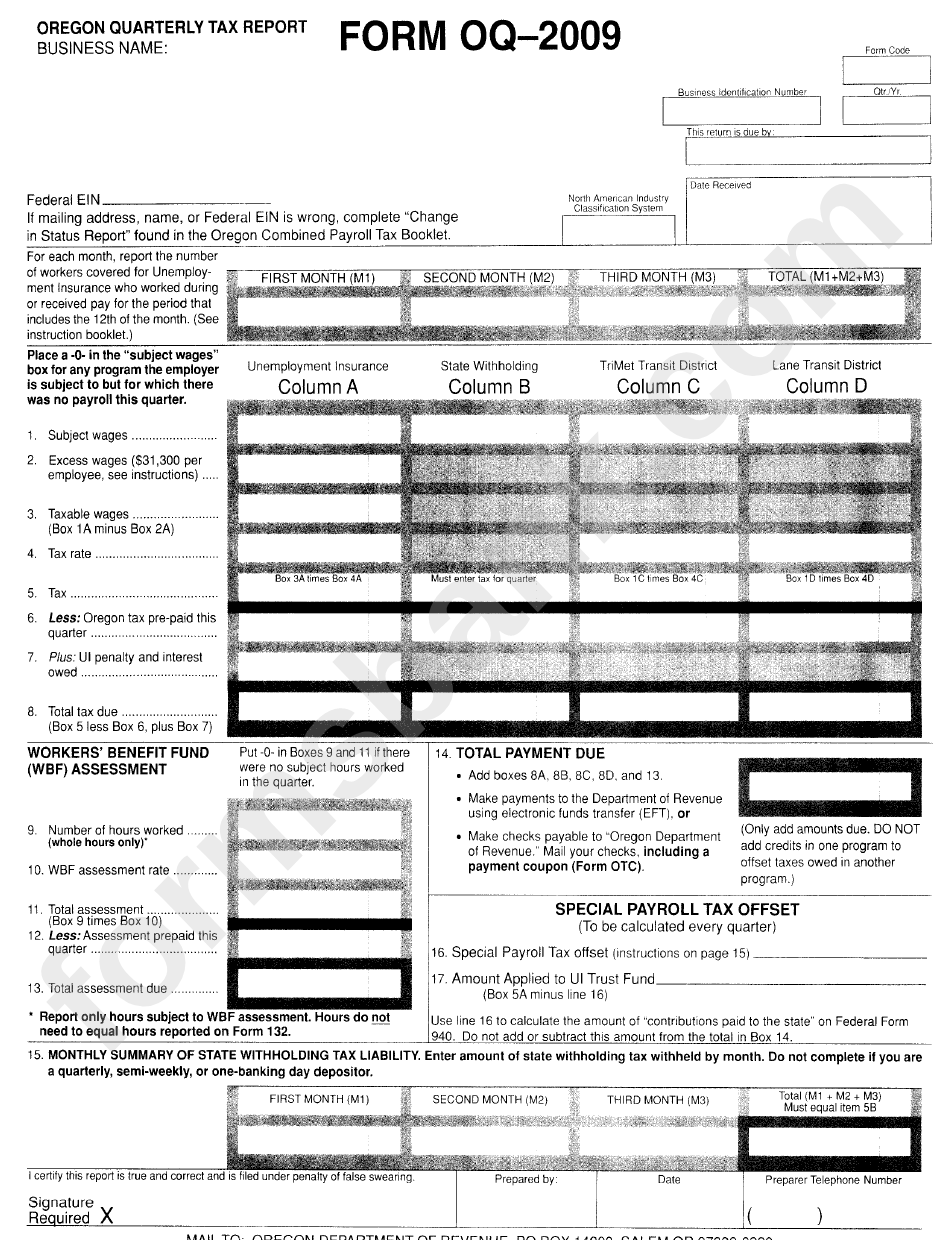

Form Oq2009 Oregon Quarterly Tax Report printable pdf download

Highway use tax bond date bond: Odot requires motor carriers to post an oregon highway use tax bond for tax collection. Regardless of your credit score or financial standing, you can your oregon highway use tax. Initial bond requests are based on the number of vehicles enrolled or operated in oregon in the. This bond is executed under ors chapter.

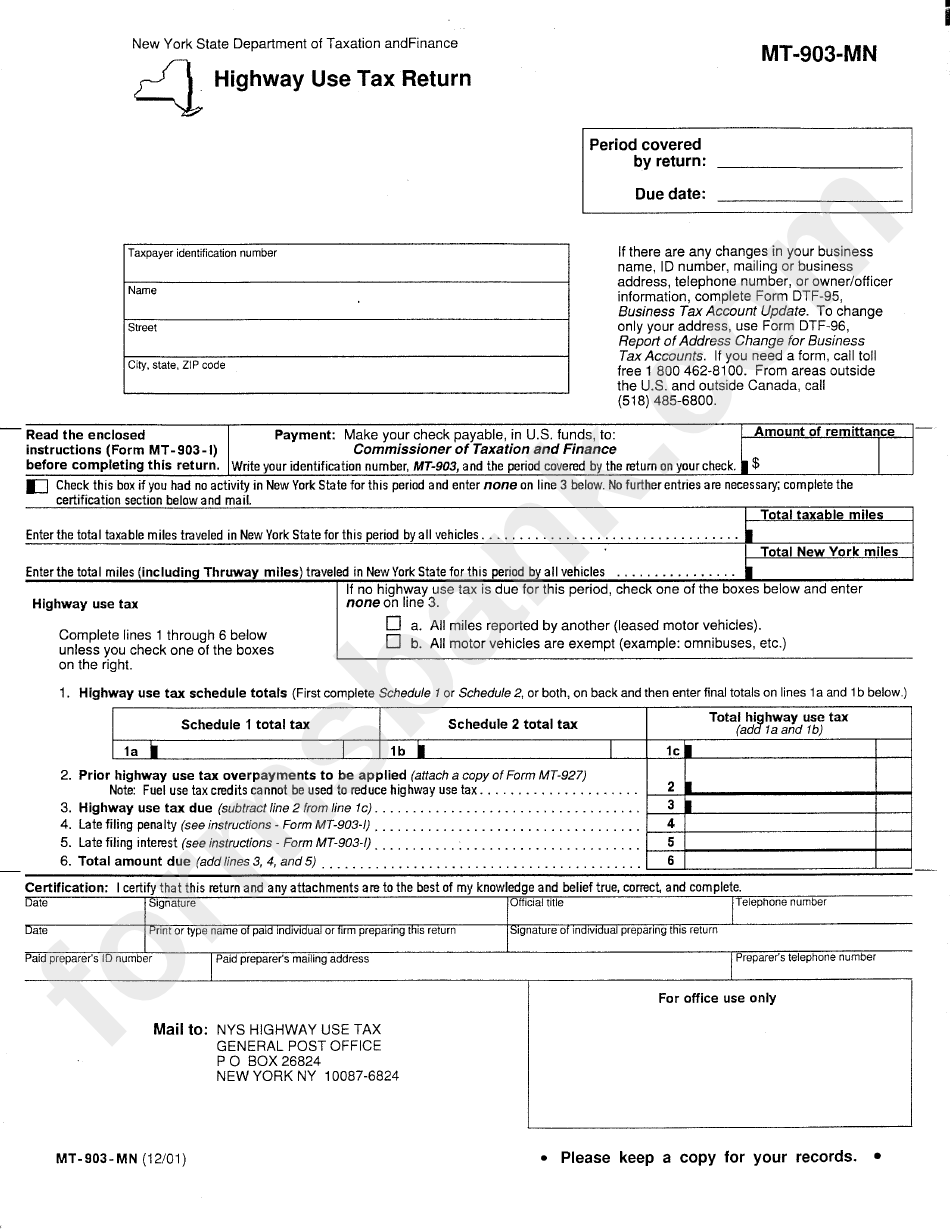

Form Mt903Mn Highway Use Tax Return printable pdf download

Highway use tax bond date bond: Odot requires motor carriers to post an oregon highway use tax bond for tax collection. Regardless of your credit score or financial standing, you can your oregon highway use tax. Initial bond requests are based on the number of vehicles enrolled or operated in oregon in the. This bond is executed under ors chapter.

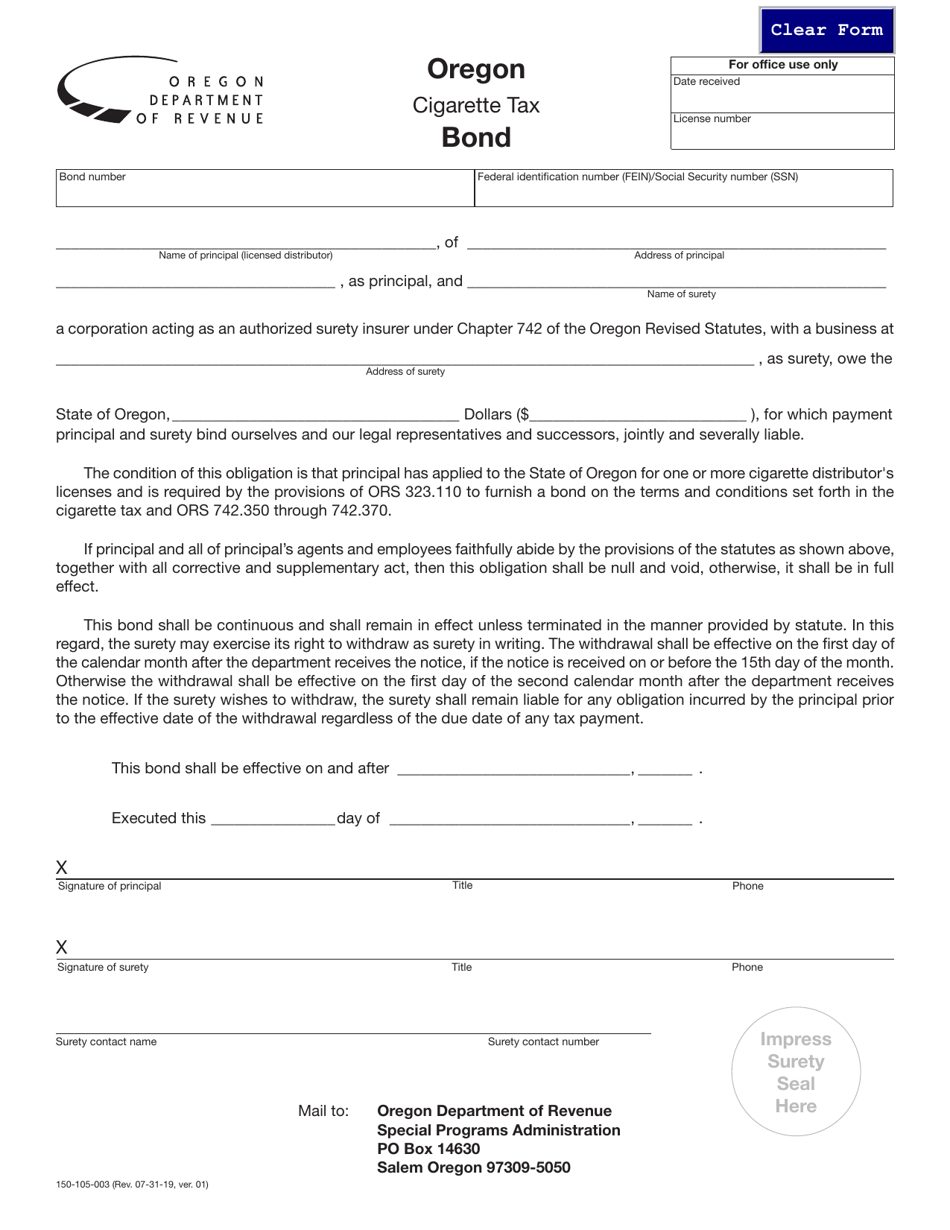

Form 150105003 Download Fillable PDF or Fill Online Oregon Cigarette

Regardless of your credit score or financial standing, you can your oregon highway use tax. Odot requires motor carriers to post an oregon highway use tax bond for tax collection. This bond is executed under ors chapter 825 to assure. Highway use tax bond date bond: Initial bond requests are based on the number of vehicles enrolled or operated in.

Oregon Highway Use Tax Bond • Surety One, Inc.

Regardless of your credit score or financial standing, you can your oregon highway use tax. Highway use tax bond date bond: Odot requires motor carriers to post an oregon highway use tax bond for tax collection. Initial bond requests are based on the number of vehicles enrolled or operated in oregon in the. This bond is executed under ors chapter.

Cigarette Tobacco Tax Bond

Odot requires motor carriers to post an oregon highway use tax bond for tax collection. Regardless of your credit score or financial standing, you can your oregon highway use tax. Initial bond requests are based on the number of vehicles enrolled or operated in oregon in the. Highway use tax bond date bond: This bond is executed under ors chapter.

Highway Permit Bond

Initial bond requests are based on the number of vehicles enrolled or operated in oregon in the. This bond is executed under ors chapter 825 to assure. Odot requires motor carriers to post an oregon highway use tax bond for tax collection. Regardless of your credit score or financial standing, you can your oregon highway use tax. Highway use tax.

Oregon department of revenue tax compliance certification Fill out

Odot requires motor carriers to post an oregon highway use tax bond for tax collection. Regardless of your credit score or financial standing, you can your oregon highway use tax. Highway use tax bond date bond: Initial bond requests are based on the number of vehicles enrolled or operated in oregon in the. This bond is executed under ors chapter.

Highway Use Tax Bond Date Bond:

Regardless of your credit score or financial standing, you can your oregon highway use tax. This bond is executed under ors chapter 825 to assure. Odot requires motor carriers to post an oregon highway use tax bond for tax collection. Initial bond requests are based on the number of vehicles enrolled or operated in oregon in the.