Non Filer Tax Form 2025 - Federal regulations require us to verify the accuracy of the information reported on your. This form should be completed if you and/or your spouse are not required to file an income tax. This form should be completed if you did not file and were not required to file a 2022 u.s.

This form should be completed if you and/or your spouse are not required to file an income tax. Federal regulations require us to verify the accuracy of the information reported on your. This form should be completed if you did not file and were not required to file a 2022 u.s.

This form should be completed if you and/or your spouse are not required to file an income tax. Federal regulations require us to verify the accuracy of the information reported on your. This form should be completed if you did not file and were not required to file a 2022 u.s.

Nonfiler filing via mail Help completing r/tax

Federal regulations require us to verify the accuracy of the information reported on your. This form should be completed if you and/or your spouse are not required to file an income tax. This form should be completed if you did not file and were not required to file a 2022 u.s.

All You Need To Know About Filer And Nonfiler In Pakistan

Federal regulations require us to verify the accuracy of the information reported on your. This form should be completed if you and/or your spouse are not required to file an income tax. This form should be completed if you did not file and were not required to file a 2022 u.s.

Fillable Online 20222023 Parent NonTax Filer Statement Fax Email

This form should be completed if you and/or your spouse are not required to file an income tax. This form should be completed if you did not file and were not required to file a 2022 u.s. Federal regulations require us to verify the accuracy of the information reported on your.

Non Filer Fillable Form Printable Forms Free Online

Federal regulations require us to verify the accuracy of the information reported on your. This form should be completed if you and/or your spouse are not required to file an income tax. This form should be completed if you did not file and were not required to file a 2022 u.s.

Filer and NonFiler Tax Rates 202324 Legalversity

This form should be completed if you and/or your spouse are not required to file an income tax. This form should be completed if you did not file and were not required to file a 2022 u.s. Federal regulations require us to verify the accuracy of the information reported on your.

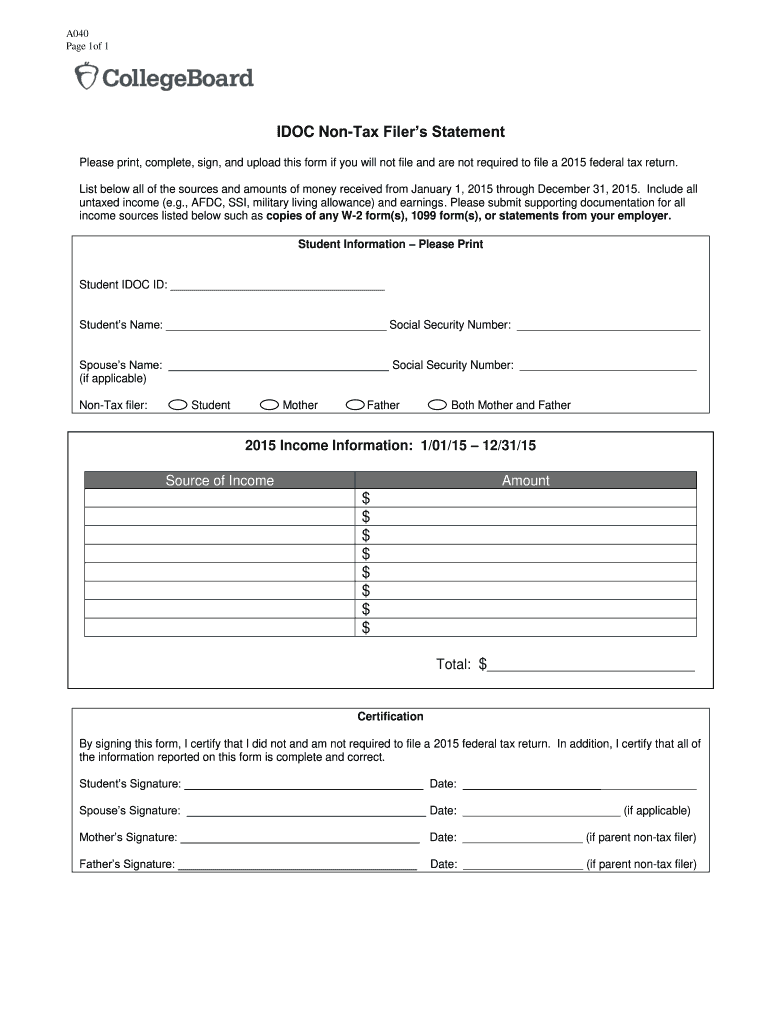

Non Tax Filer Statement Idoc No airSlate SignNow

Federal regulations require us to verify the accuracy of the information reported on your. This form should be completed if you did not file and were not required to file a 2022 u.s. This form should be completed if you and/or your spouse are not required to file an income tax.

Non Filer Fillable Form Printable Forms Free Online

Federal regulations require us to verify the accuracy of the information reported on your. This form should be completed if you did not file and were not required to file a 2022 u.s. This form should be completed if you and/or your spouse are not required to file an income tax.

Completing the NonTax Filer Form CFAA

This form should be completed if you and/or your spouse are not required to file an income tax. Federal regulations require us to verify the accuracy of the information reported on your. This form should be completed if you did not file and were not required to file a 2022 u.s.

Non Filer Tax Form 2024 Karin Madelena

Federal regulations require us to verify the accuracy of the information reported on your. This form should be completed if you and/or your spouse are not required to file an income tax. This form should be completed if you did not file and were not required to file a 2022 u.s.

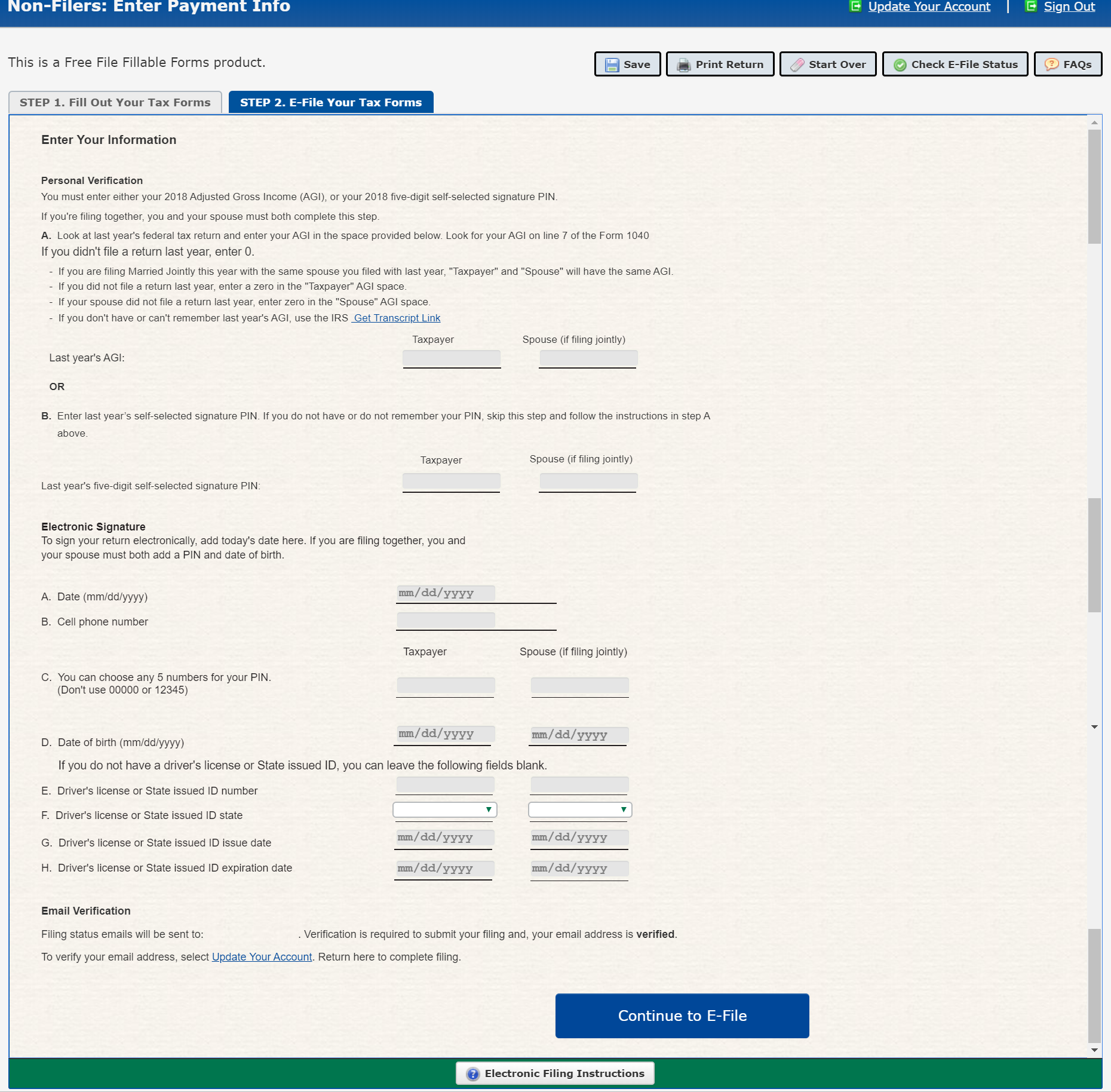

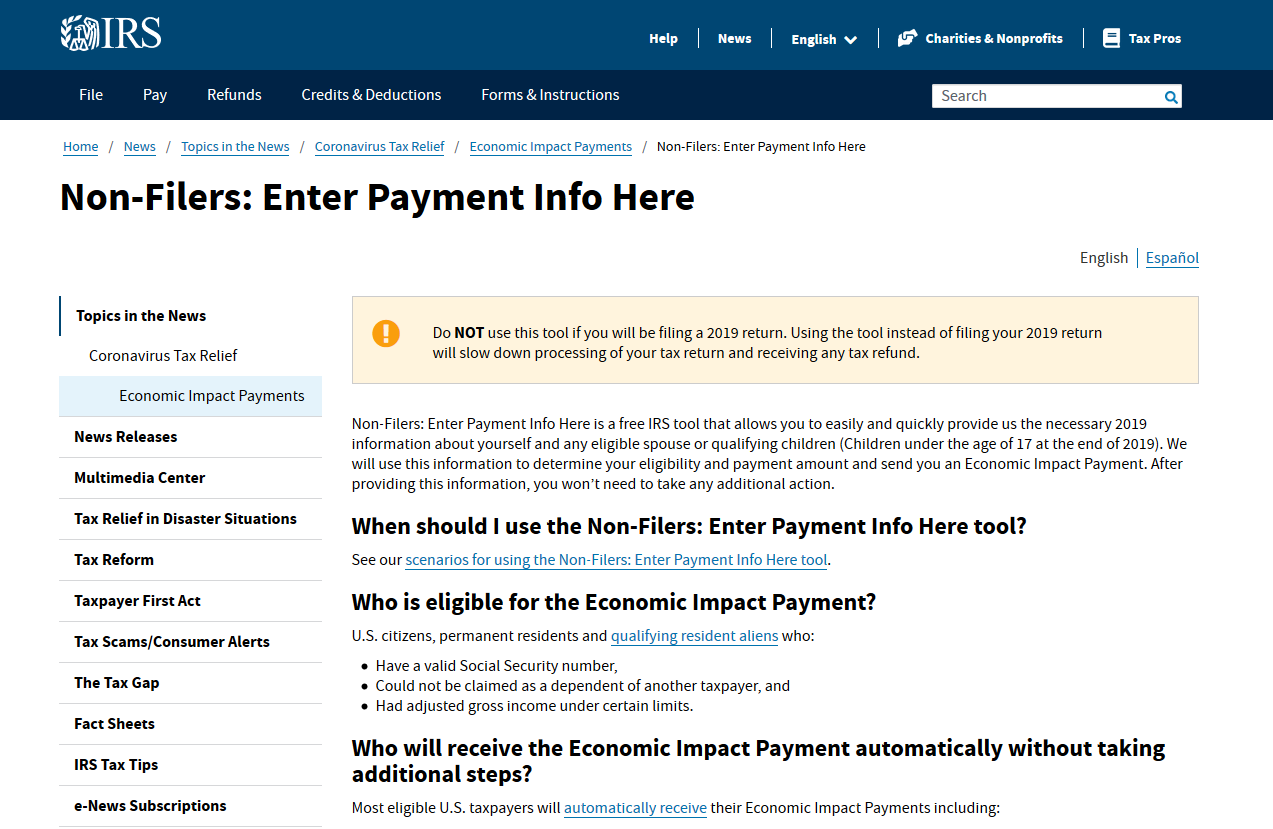

(ARCHIVE) How to Fill out the IRS NonFiler Form Get It Back

This form should be completed if you and/or your spouse are not required to file an income tax. This form should be completed if you did not file and were not required to file a 2022 u.s. Federal regulations require us to verify the accuracy of the information reported on your.

This Form Should Be Completed If You Did Not File And Were Not Required To File A 2022 U.s.

Federal regulations require us to verify the accuracy of the information reported on your. This form should be completed if you and/or your spouse are not required to file an income tax.