Maryland Withholding Form 2025 - • if the employee wants to continue claiming exemption from federal and/or state. 2025 employer withholding forms and instruction booklets. Percentage method of withholding for 2.75 percent local income tax (a) married filing. Form mw506nrs is designed to assure the regular and timely collection of maryland. Instructions for complying with the requirements for withholding maryland income tax as. Form used to determine the amount of income tax withholding due on the sale of property located.

Form mw506nrs is designed to assure the regular and timely collection of maryland. Instructions for complying with the requirements for withholding maryland income tax as. Percentage method of withholding for 2.75 percent local income tax (a) married filing. • if the employee wants to continue claiming exemption from federal and/or state. 2025 employer withholding forms and instruction booklets. Form used to determine the amount of income tax withholding due on the sale of property located.

Form used to determine the amount of income tax withholding due on the sale of property located. Percentage method of withholding for 2.75 percent local income tax (a) married filing. • if the employee wants to continue claiming exemption from federal and/or state. 2025 employer withholding forms and instruction booklets. Instructions for complying with the requirements for withholding maryland income tax as. Form mw506nrs is designed to assure the regular and timely collection of maryland.

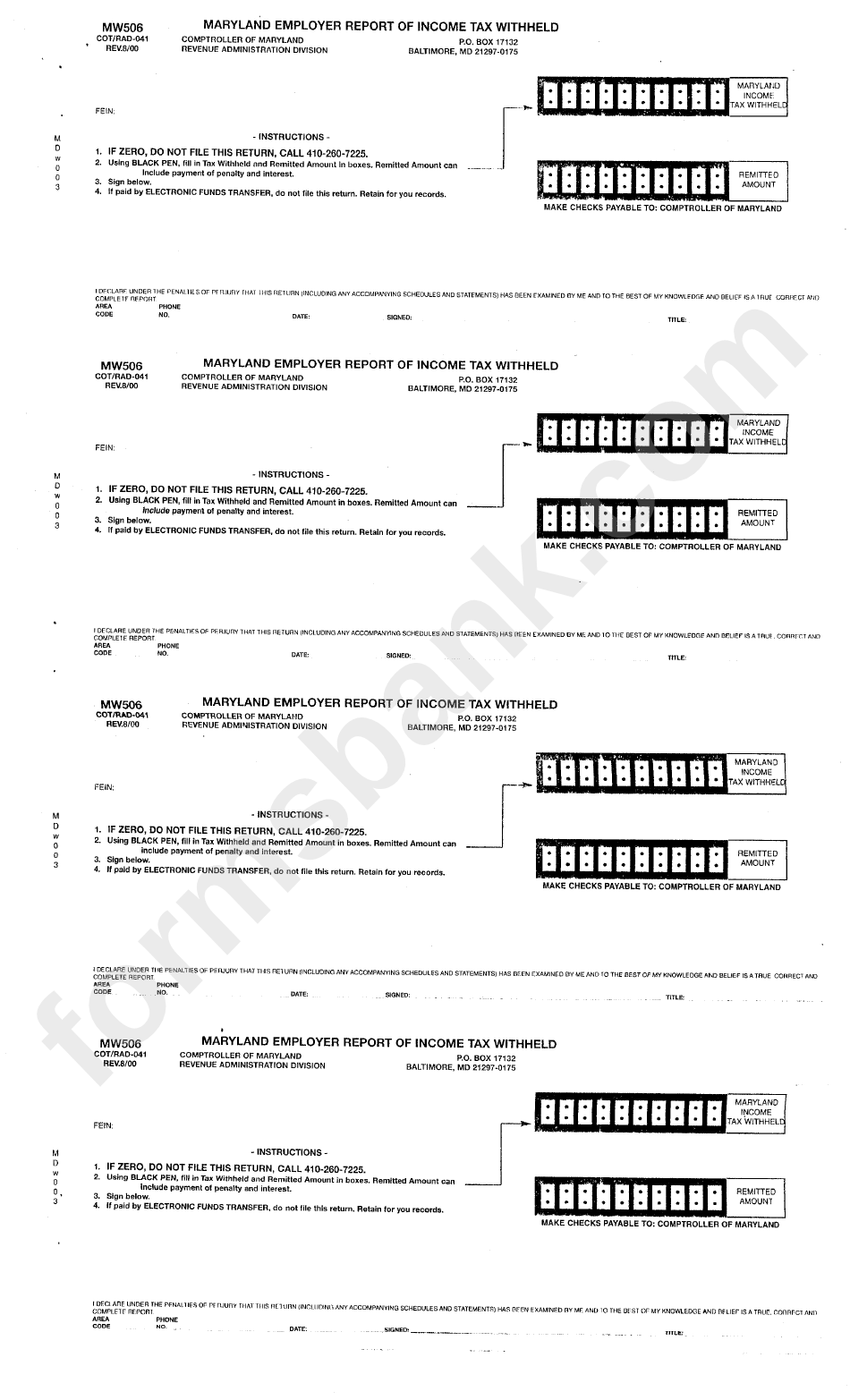

Form Mw506 Maryland Employer Report Of Tax Withheld printable

Instructions for complying with the requirements for withholding maryland income tax as. • if the employee wants to continue claiming exemption from federal and/or state. 2025 employer withholding forms and instruction booklets. Form mw506nrs is designed to assure the regular and timely collection of maryland. Form used to determine the amount of income tax withholding due on the sale of.

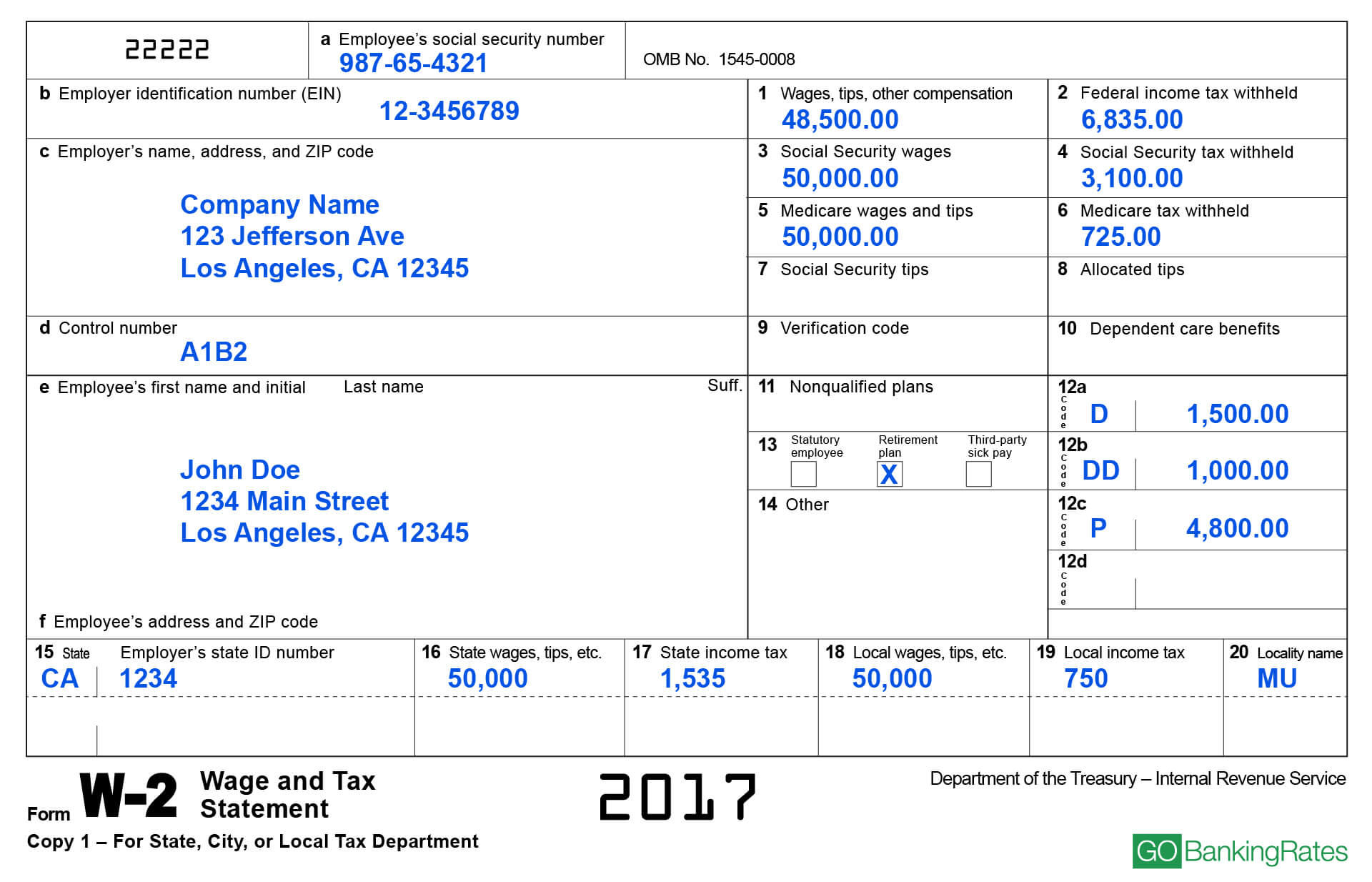

Maryland Tax Withholding Form 2021 2022 W4 Form

Instructions for complying with the requirements for withholding maryland income tax as. 2025 employer withholding forms and instruction booklets. Form mw506nrs is designed to assure the regular and timely collection of maryland. Percentage method of withholding for 2.75 percent local income tax (a) married filing. Form used to determine the amount of income tax withholding due on the sale of.

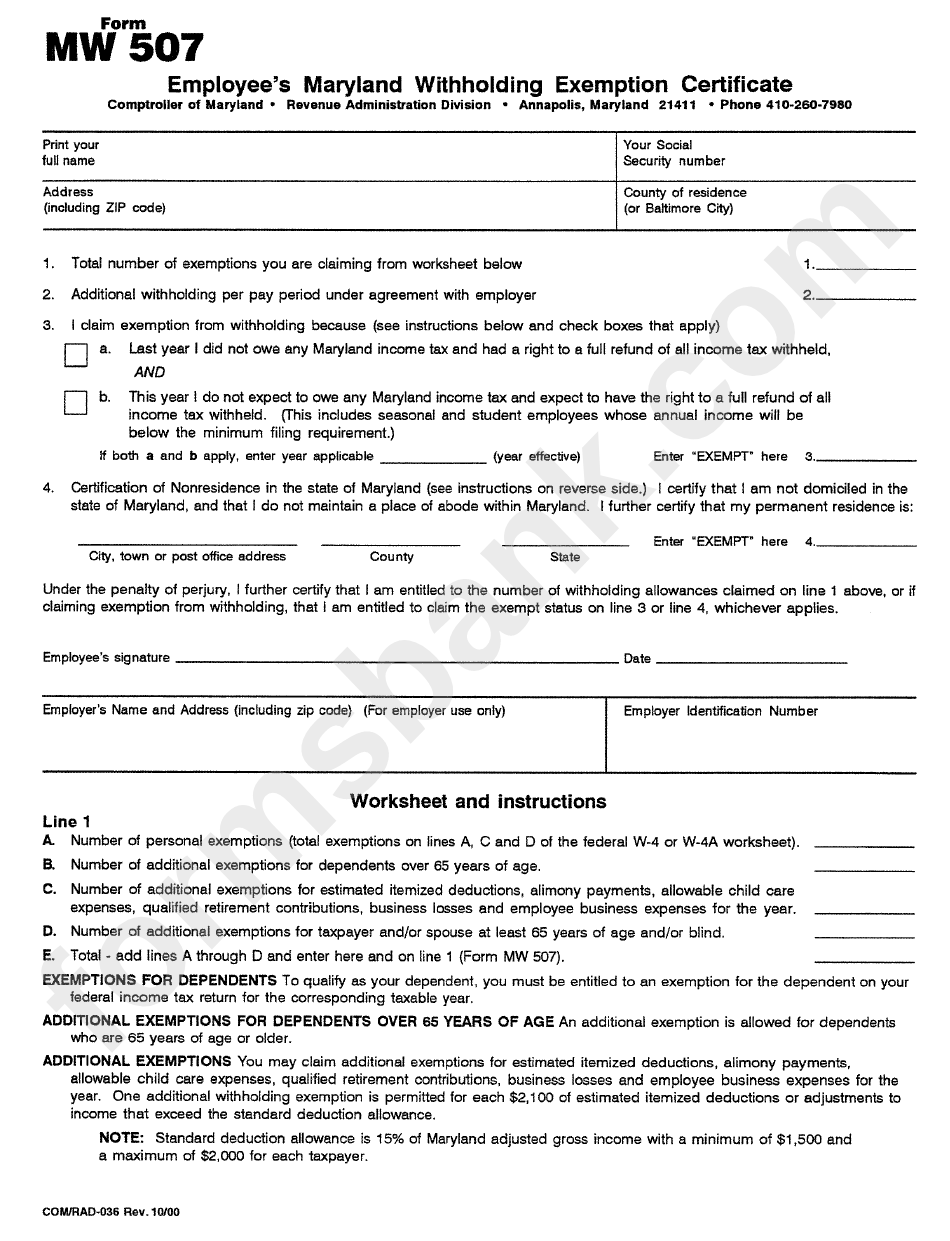

Maryland Withholding Form 2024 Dani Millie

Form mw506nrs is designed to assure the regular and timely collection of maryland. Instructions for complying with the requirements for withholding maryland income tax as. • if the employee wants to continue claiming exemption from federal and/or state. Form used to determine the amount of income tax withholding due on the sale of property located. Percentage method of withholding for.

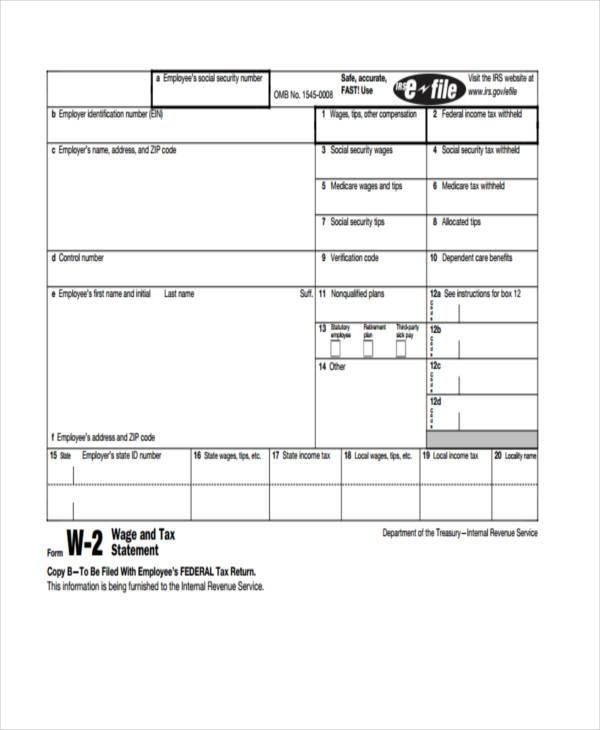

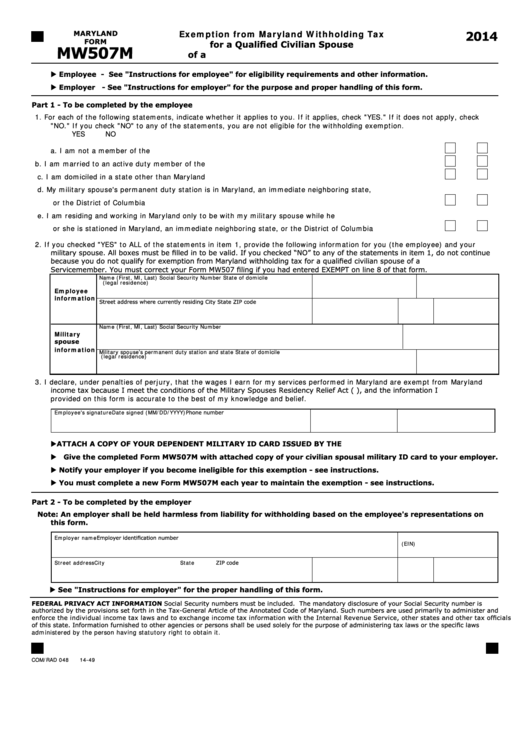

Federal And Maryland State Tax Withholding Request Form

Form mw506nrs is designed to assure the regular and timely collection of maryland. • if the employee wants to continue claiming exemption from federal and/or state. 2025 employer withholding forms and instruction booklets. Instructions for complying with the requirements for withholding maryland income tax as. Form used to determine the amount of income tax withholding due on the sale of.

Maryland Withholding Form 2024 Dani Millie

Form mw506nrs is designed to assure the regular and timely collection of maryland. Percentage method of withholding for 2.75 percent local income tax (a) married filing. 2025 employer withholding forms and instruction booklets. • if the employee wants to continue claiming exemption from federal and/or state. Form used to determine the amount of income tax withholding due on the sale.

California Employee Withholding Form 2024 Ivonne Jobina

Form used to determine the amount of income tax withholding due on the sale of property located. Percentage method of withholding for 2.75 percent local income tax (a) married filing. • if the employee wants to continue claiming exemption from federal and/or state. Form mw506nrs is designed to assure the regular and timely collection of maryland. 2025 employer withholding forms.

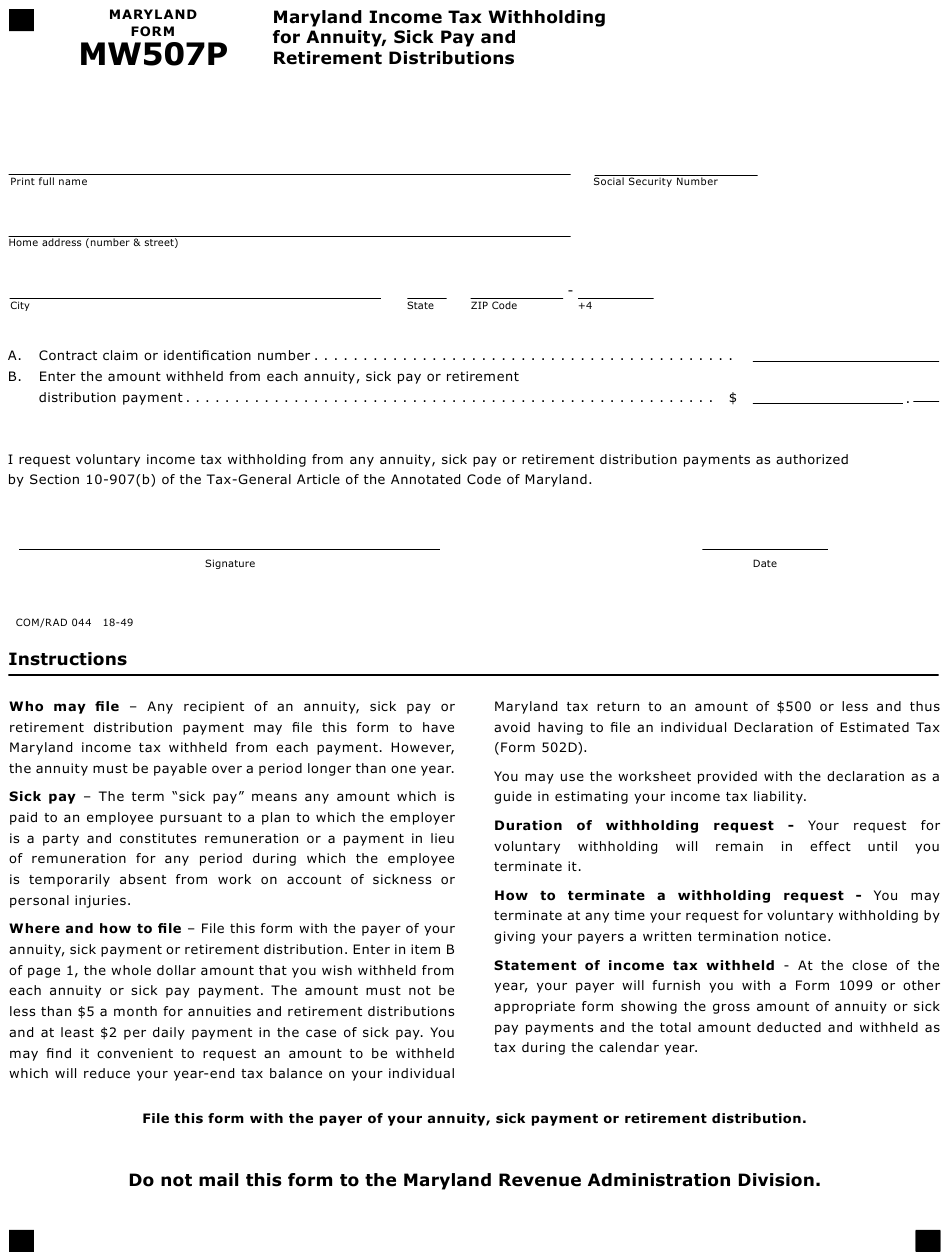

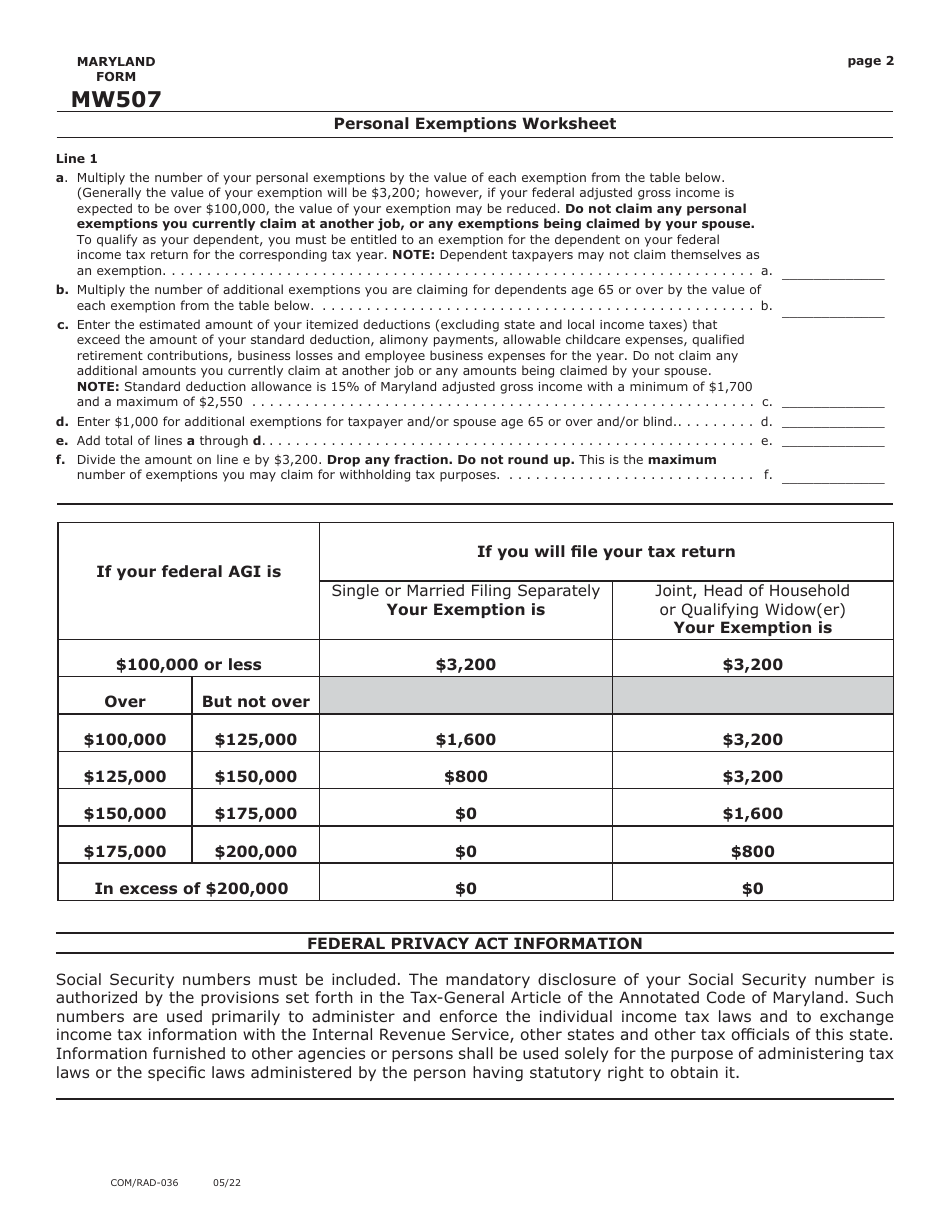

Maryland Form MW507 2022 Fill Out, Sign Online and

Form used to determine the amount of income tax withholding due on the sale of property located. Form mw506nrs is designed to assure the regular and timely collection of maryland. • if the employee wants to continue claiming exemption from federal and/or state. Percentage method of withholding for 2.75 percent local income tax (a) married filing. 2025 employer withholding forms.

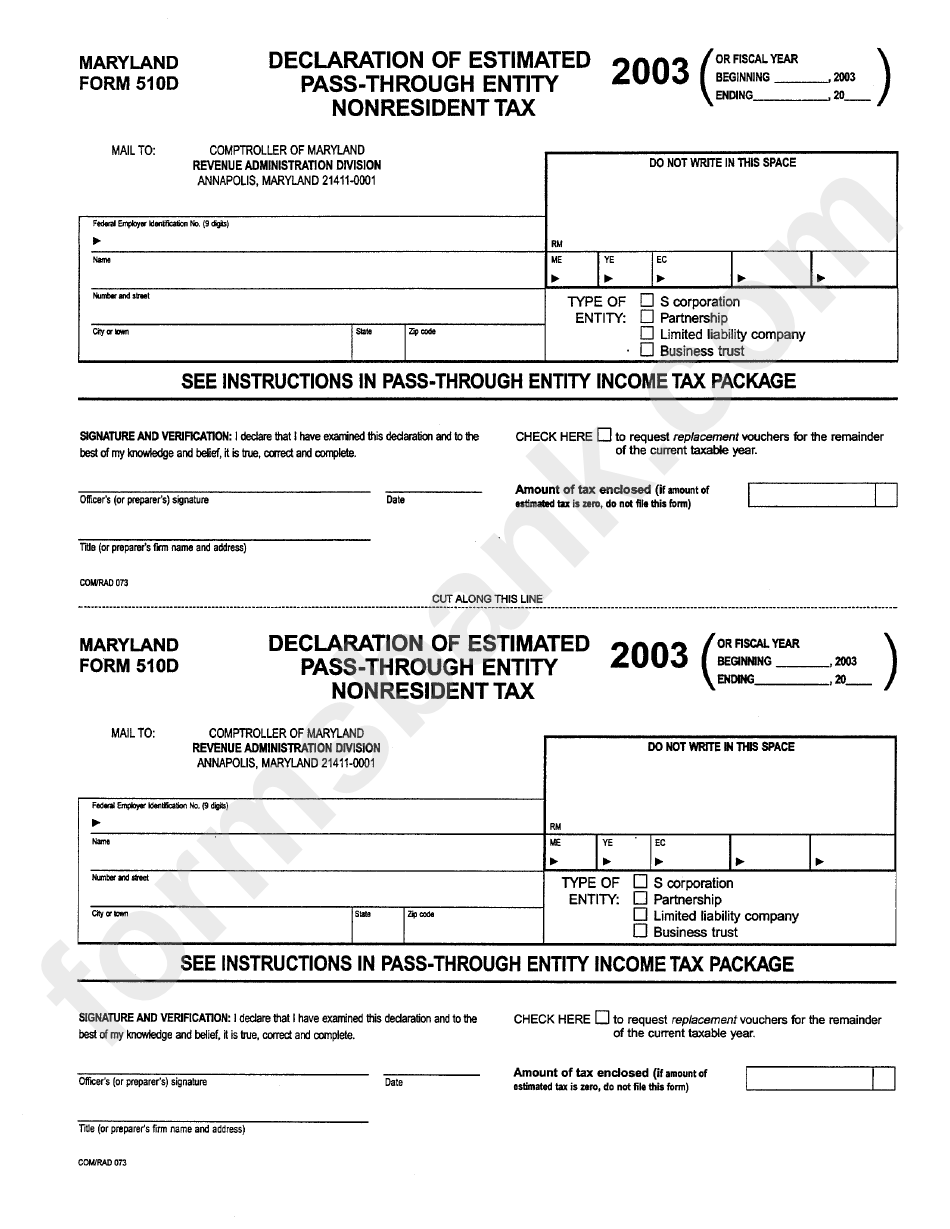

Maryland State Tax Employer Withholding Form

Percentage method of withholding for 2.75 percent local income tax (a) married filing. Form mw506nrs is designed to assure the regular and timely collection of maryland. • if the employee wants to continue claiming exemption from federal and/or state. 2025 employer withholding forms and instruction booklets. Instructions for complying with the requirements for withholding maryland income tax as.

Maryland State Withholding Tax Form 2022

Percentage method of withholding for 2.75 percent local income tax (a) married filing. 2025 employer withholding forms and instruction booklets. Instructions for complying with the requirements for withholding maryland income tax as. Form mw506nrs is designed to assure the regular and timely collection of maryland. • if the employee wants to continue claiming exemption from federal and/or state.

Maryland Withholding Tax Form

Form mw506nrs is designed to assure the regular and timely collection of maryland. • if the employee wants to continue claiming exemption from federal and/or state. Percentage method of withholding for 2.75 percent local income tax (a) married filing. Form used to determine the amount of income tax withholding due on the sale of property located. 2025 employer withholding forms.

2025 Employer Withholding Forms And Instruction Booklets.

Form used to determine the amount of income tax withholding due on the sale of property located. • if the employee wants to continue claiming exemption from federal and/or state. Form mw506nrs is designed to assure the regular and timely collection of maryland. Percentage method of withholding for 2.75 percent local income tax (a) married filing.