Id Theft Prevention Program - Each financial institution or creditor that offers or maintains one or more covered accounts must. The fair and accurate credit transactions (fact) act requires financial. Each financial institution or creditor that offers or maintains one or more covered accounts must. The red flags rule requires many businesses and organizations to implement a written identity. The red flags rule 1 requires many businesses and organizations to implement a. Each financial institution or creditor that offers or maintains one or more covered accounts must. The red flags rule requires specified firms to create a written identity theft prevention.

The red flags rule requires specified firms to create a written identity theft prevention. Each financial institution or creditor that offers or maintains one or more covered accounts must. Each financial institution or creditor that offers or maintains one or more covered accounts must. Each financial institution or creditor that offers or maintains one or more covered accounts must. The red flags rule requires many businesses and organizations to implement a written identity. The red flags rule 1 requires many businesses and organizations to implement a. The fair and accurate credit transactions (fact) act requires financial.

Each financial institution or creditor that offers or maintains one or more covered accounts must. The red flags rule requires many businesses and organizations to implement a written identity. The fair and accurate credit transactions (fact) act requires financial. The red flags rule 1 requires many businesses and organizations to implement a. Each financial institution or creditor that offers or maintains one or more covered accounts must. The red flags rule requires specified firms to create a written identity theft prevention. Each financial institution or creditor that offers or maintains one or more covered accounts must.

Identity Theft Prevention ICA Agency Alliance, Inc.

Each financial institution or creditor that offers or maintains one or more covered accounts must. The red flags rule requires many businesses and organizations to implement a written identity. Each financial institution or creditor that offers or maintains one or more covered accounts must. The red flags rule 1 requires many businesses and organizations to implement a. The fair and.

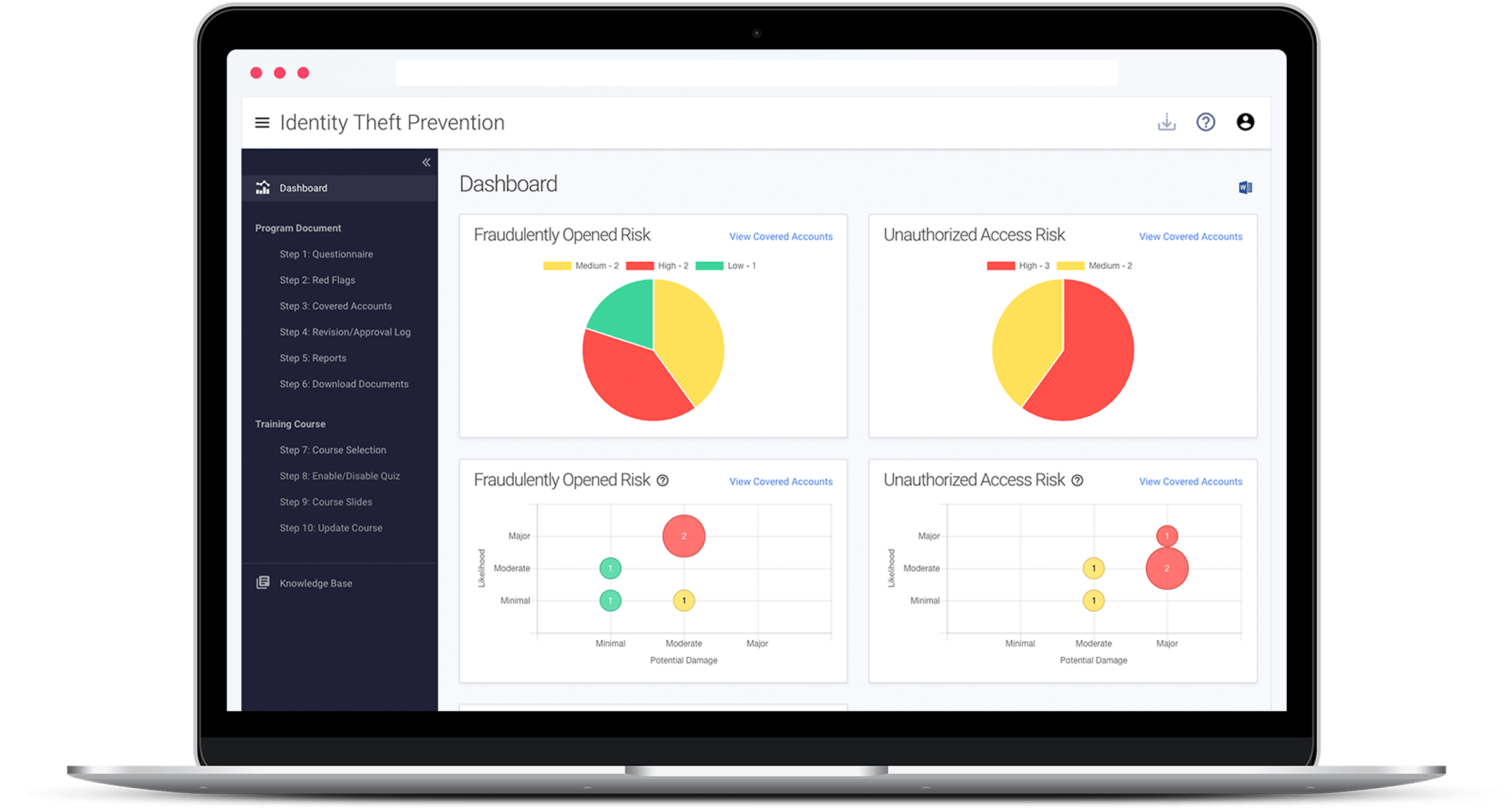

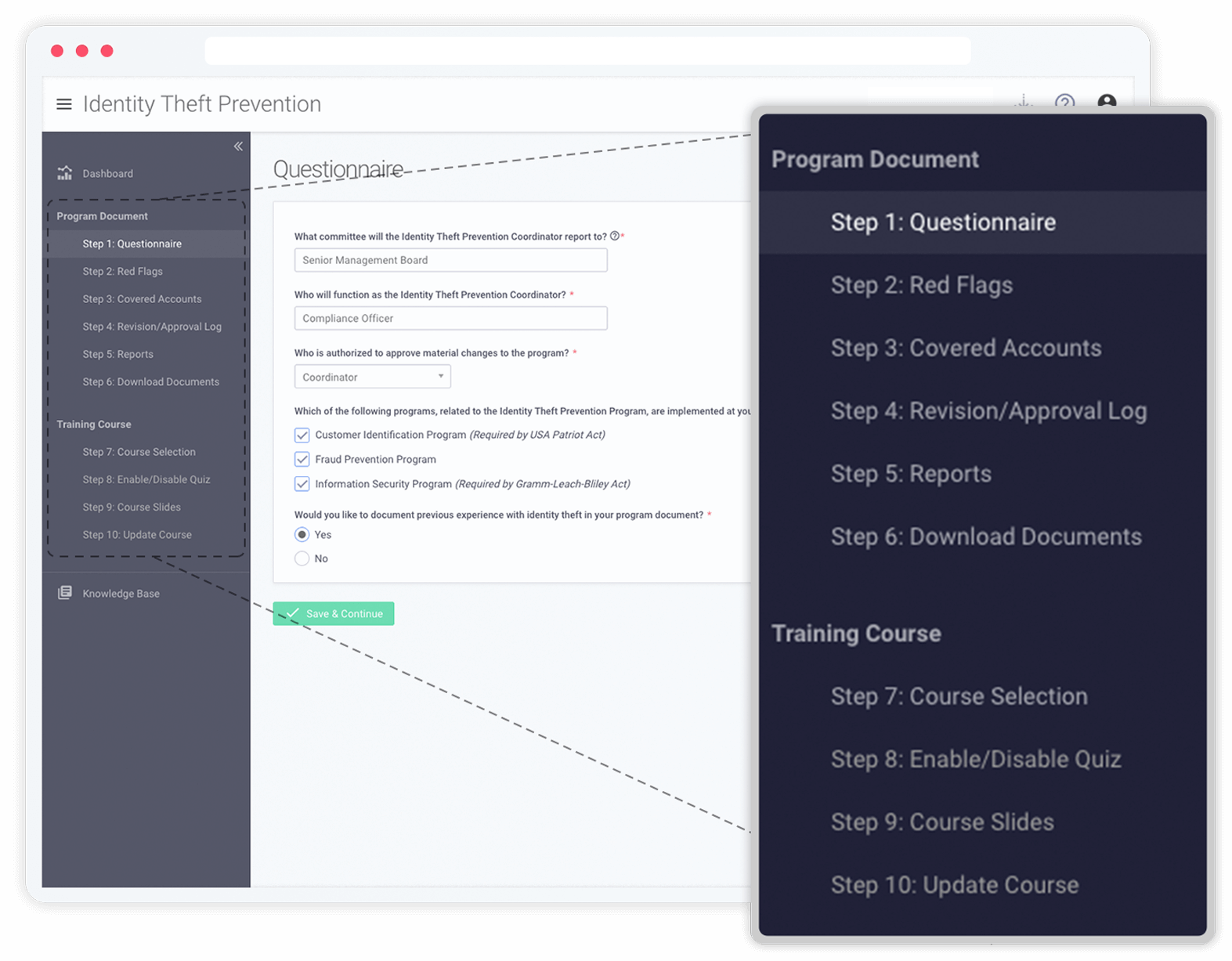

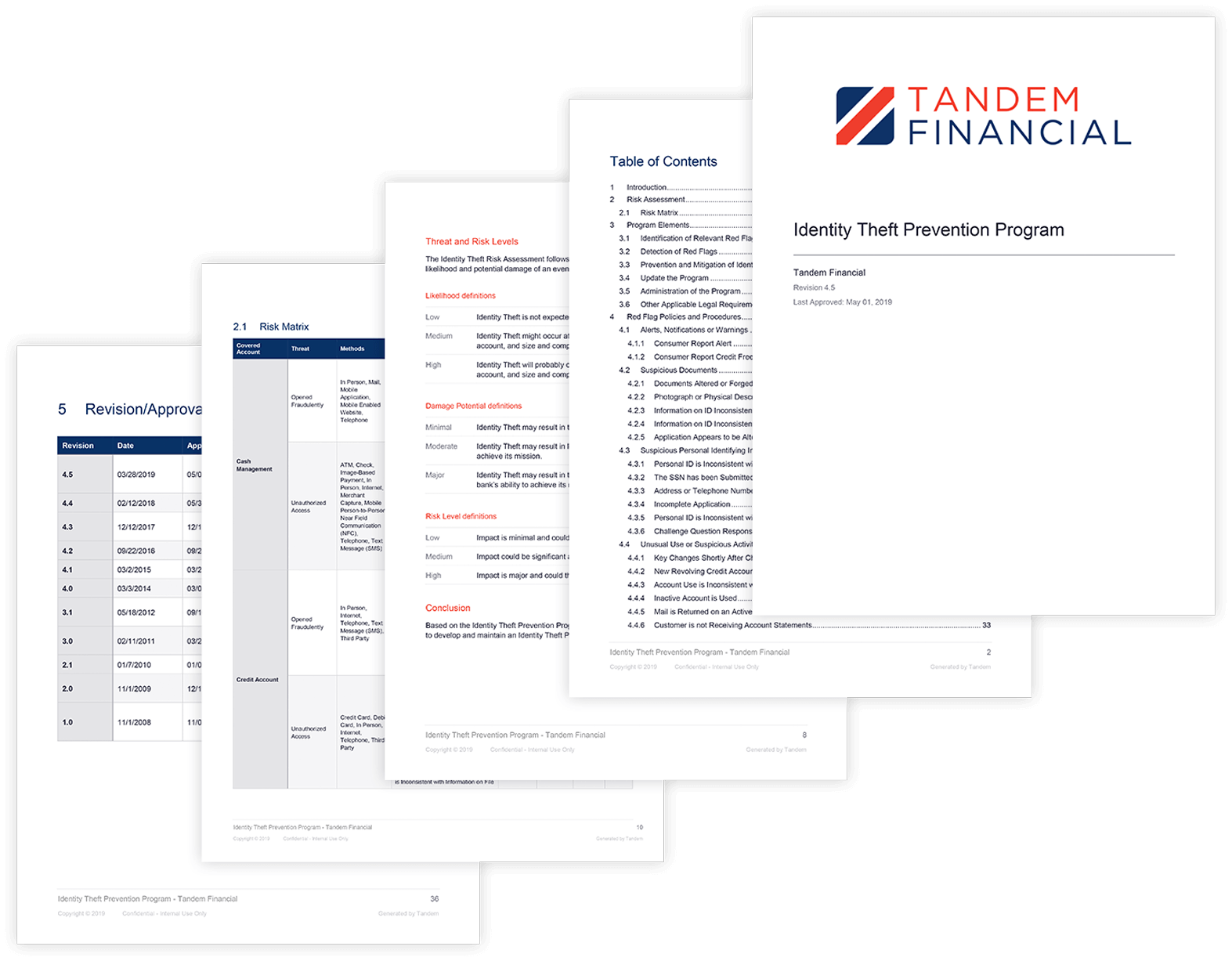

Identity Theft Prevention Program Software Tandem

The red flags rule requires specified firms to create a written identity theft prevention. The red flags rule 1 requires many businesses and organizations to implement a. Each financial institution or creditor that offers or maintains one or more covered accounts must. Each financial institution or creditor that offers or maintains one or more covered accounts must. Each financial institution.

Cardholders still dropping the ball when it comes to basic ID theft

Each financial institution or creditor that offers or maintains one or more covered accounts must. The red flags rule requires specified firms to create a written identity theft prevention. The red flags rule requires many businesses and organizations to implement a written identity. Each financial institution or creditor that offers or maintains one or more covered accounts must. The fair.

Identity Theft Prevention Program Software Tandem

The red flags rule 1 requires many businesses and organizations to implement a. Each financial institution or creditor that offers or maintains one or more covered accounts must. The red flags rule requires many businesses and organizations to implement a written identity. The red flags rule requires specified firms to create a written identity theft prevention. The fair and accurate.

Identity Theft Prevention Program — Lake Odessa Community Library

Each financial institution or creditor that offers or maintains one or more covered accounts must. The red flags rule requires specified firms to create a written identity theft prevention. Each financial institution or creditor that offers or maintains one or more covered accounts must. Each financial institution or creditor that offers or maintains one or more covered accounts must. The.

Identity Theft Prevention Program Software Tandem

The fair and accurate credit transactions (fact) act requires financial. The red flags rule requires specified firms to create a written identity theft prevention. Each financial institution or creditor that offers or maintains one or more covered accounts must. The red flags rule 1 requires many businesses and organizations to implement a. The red flags rule requires many businesses and.

Tips for Identity Theft Prevention Paysign, Inc.

The red flags rule requires specified firms to create a written identity theft prevention. Each financial institution or creditor that offers or maintains one or more covered accounts must. Each financial institution or creditor that offers or maintains one or more covered accounts must. The red flags rule requires many businesses and organizations to implement a written identity. Each financial.

Attorney General ID Theft Prevention Home

The red flags rule 1 requires many businesses and organizations to implement a. The fair and accurate credit transactions (fact) act requires financial. Each financial institution or creditor that offers or maintains one or more covered accounts must. Each financial institution or creditor that offers or maintains one or more covered accounts must. The red flags rule requires many businesses.

Attorney General ID Theft Prevention Home

The red flags rule requires specified firms to create a written identity theft prevention. The red flags rule requires many businesses and organizations to implement a written identity. The fair and accurate credit transactions (fact) act requires financial. Each financial institution or creditor that offers or maintains one or more covered accounts must. The red flags rule 1 requires many.

Identity Theft Prevention Program

The red flags rule 1 requires many businesses and organizations to implement a. Each financial institution or creditor that offers or maintains one or more covered accounts must. Each financial institution or creditor that offers or maintains one or more covered accounts must. The red flags rule requires many businesses and organizations to implement a written identity. The red flags.

The Red Flags Rule Requires Specified Firms To Create A Written Identity Theft Prevention.

Each financial institution or creditor that offers or maintains one or more covered accounts must. Each financial institution or creditor that offers or maintains one or more covered accounts must. The red flags rule 1 requires many businesses and organizations to implement a. The red flags rule requires many businesses and organizations to implement a written identity.

Each Financial Institution Or Creditor That Offers Or Maintains One Or More Covered Accounts Must.

The fair and accurate credit transactions (fact) act requires financial.