Discharged Debt Taxable Income - Any carryover to or from the taxable year of a discharge of an amount for purposes for determining the amount allowable as a credit. Generally, if you owe a debt to someone else and they cancel or forgive that debt for less than its full amount, you are treated for income tax. Unfortunately, when you are relieved of debt through the cancellation of. In general, if you have cancellation of debt income because your debt is canceled, forgiven, or discharged for less than the amount you must. Of course, the short answer is yes, this is taxable income.

Generally, if you owe a debt to someone else and they cancel or forgive that debt for less than its full amount, you are treated for income tax. Any carryover to or from the taxable year of a discharge of an amount for purposes for determining the amount allowable as a credit. Of course, the short answer is yes, this is taxable income. Unfortunately, when you are relieved of debt through the cancellation of. In general, if you have cancellation of debt income because your debt is canceled, forgiven, or discharged for less than the amount you must.

Generally, if you owe a debt to someone else and they cancel or forgive that debt for less than its full amount, you are treated for income tax. Unfortunately, when you are relieved of debt through the cancellation of. In general, if you have cancellation of debt income because your debt is canceled, forgiven, or discharged for less than the amount you must. Any carryover to or from the taxable year of a discharge of an amount for purposes for determining the amount allowable as a credit. Of course, the short answer is yes, this is taxable income.

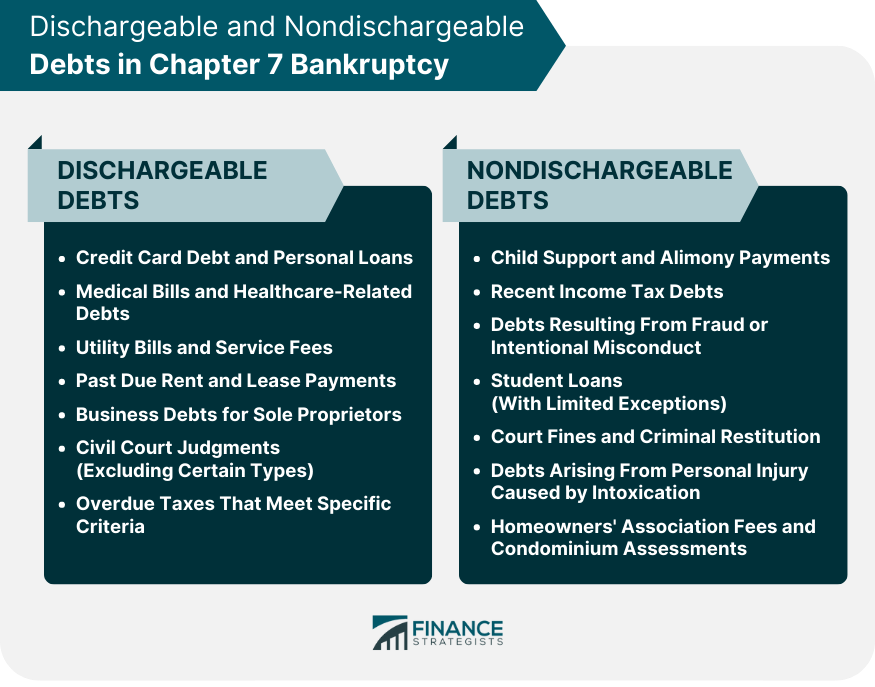

What Debts Are Discharged in Chapter 7 Bankruptcy?

Any carryover to or from the taxable year of a discharge of an amount for purposes for determining the amount allowable as a credit. Unfortunately, when you are relieved of debt through the cancellation of. In general, if you have cancellation of debt income because your debt is canceled, forgiven, or discharged for less than the amount you must. Of.

Does a Bankruptcy Affect Your Tax Return? Finance Strategists

Any carryover to or from the taxable year of a discharge of an amount for purposes for determining the amount allowable as a credit. Generally, if you owe a debt to someone else and they cancel or forgive that debt for less than its full amount, you are treated for income tax. In general, if you have cancellation of debt.

Discharge of Debt (from The Tools & Techniques of Tax

Unfortunately, when you are relieved of debt through the cancellation of. Of course, the short answer is yes, this is taxable income. In general, if you have cancellation of debt income because your debt is canceled, forgiven, or discharged for less than the amount you must. Generally, if you owe a debt to someone else and they cancel or forgive.

Discharge of Debt (from The Tools & Techniques of Tax

Generally, if you owe a debt to someone else and they cancel or forgive that debt for less than its full amount, you are treated for income tax. Unfortunately, when you are relieved of debt through the cancellation of. Any carryover to or from the taxable year of a discharge of an amount for purposes for determining the amount allowable.

Is the debt discharged in bankruptcy that has to be reported on

Unfortunately, when you are relieved of debt through the cancellation of. In general, if you have cancellation of debt income because your debt is canceled, forgiven, or discharged for less than the amount you must. Any carryover to or from the taxable year of a discharge of an amount for purposes for determining the amount allowable as a credit. Generally,.

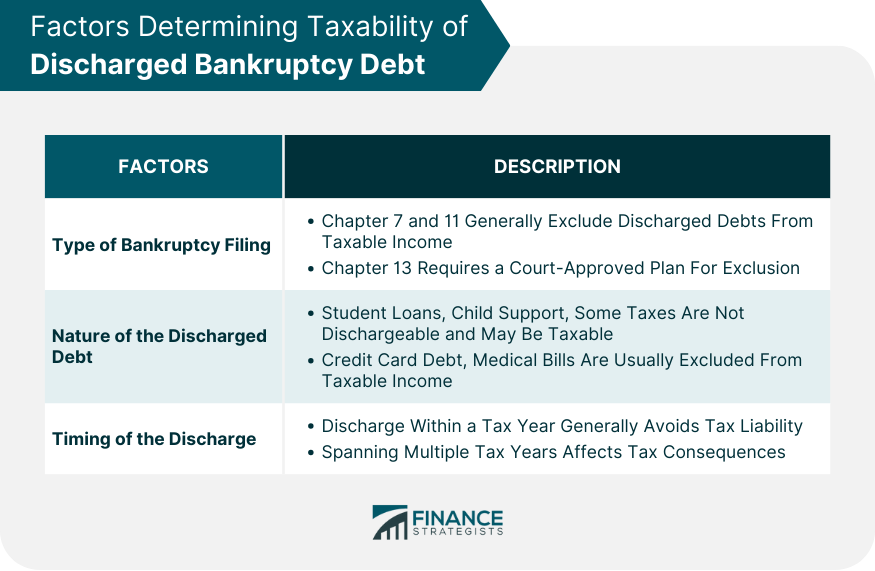

Do You Have to Pay Taxes on Discharged Bankruptcy Debt?

Any carryover to or from the taxable year of a discharge of an amount for purposes for determining the amount allowable as a credit. In general, if you have cancellation of debt income because your debt is canceled, forgiven, or discharged for less than the amount you must. Generally, if you owe a debt to someone else and they cancel.

Form 982 IRS How to Reduce Your Tax Liability Through Debt Discharge?

Any carryover to or from the taxable year of a discharge of an amount for purposes for determining the amount allowable as a credit. Of course, the short answer is yes, this is taxable income. Generally, if you owe a debt to someone else and they cancel or forgive that debt for less than its full amount, you are treated.

How to fill out I.R.S. form 1099A to discharge debt. Financial life

Of course, the short answer is yes, this is taxable income. Generally, if you owe a debt to someone else and they cancel or forgive that debt for less than its full amount, you are treated for income tax. Unfortunately, when you are relieved of debt through the cancellation of. In general, if you have cancellation of debt income because.

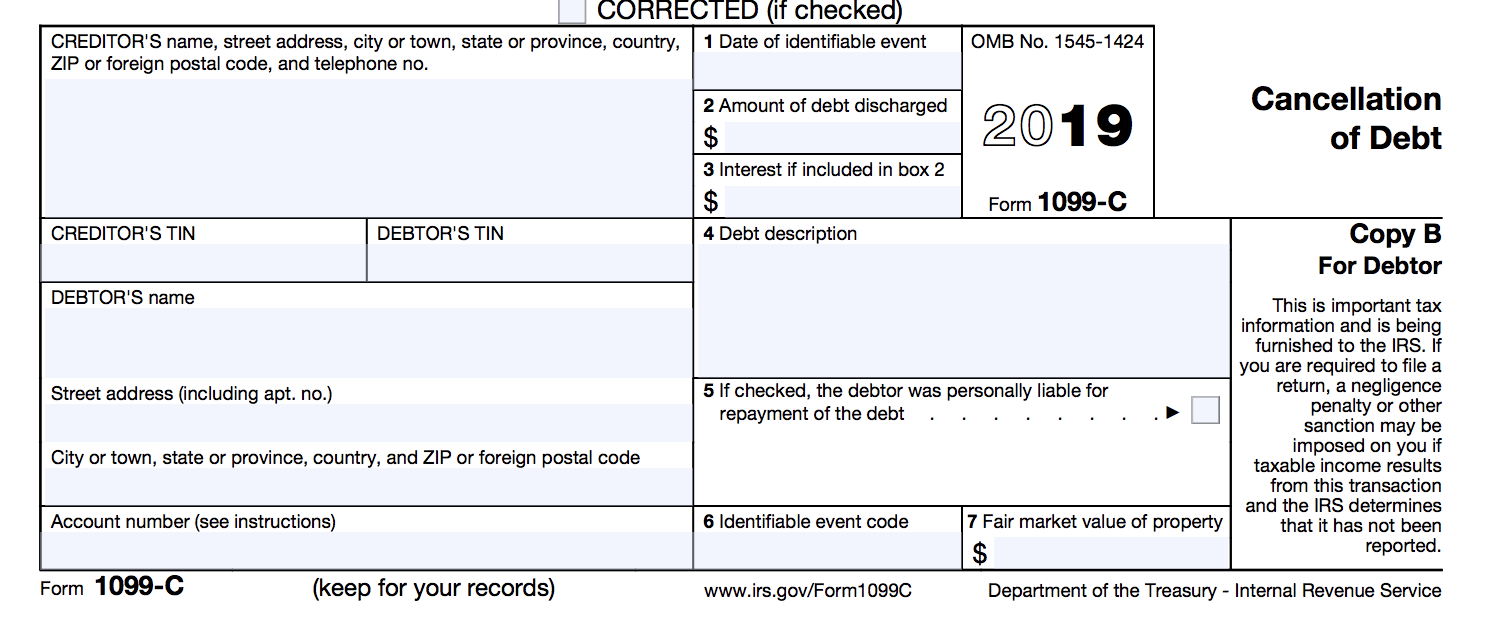

IRS Form 1099C Taxes on Discharged Debt SuperMoney

Generally, if you owe a debt to someone else and they cancel or forgive that debt for less than its full amount, you are treated for income tax. Of course, the short answer is yes, this is taxable income. In general, if you have cancellation of debt income because your debt is canceled, forgiven, or discharged for less than the.

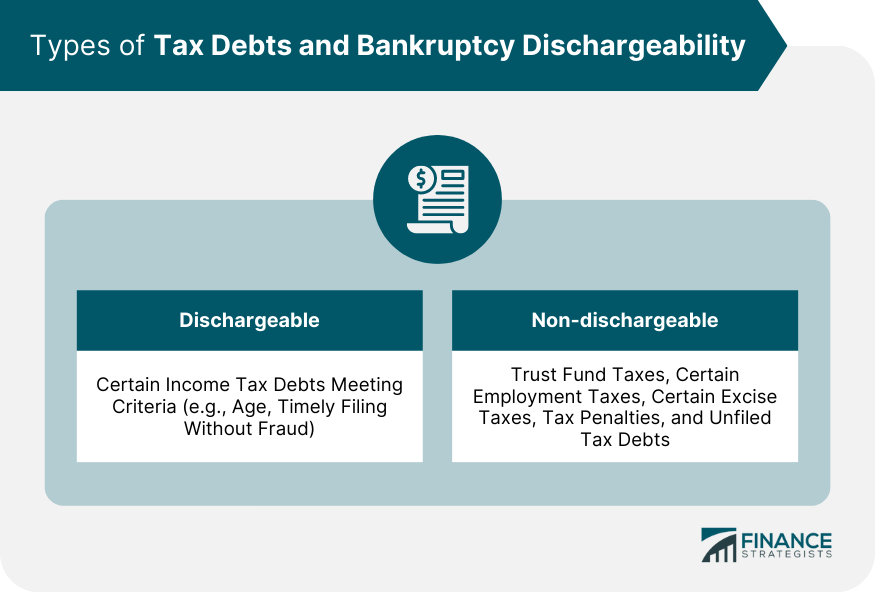

Can I Discharge Tax Debt Through Bankruptcy? Dethlefs Pykosh

Unfortunately, when you are relieved of debt through the cancellation of. Any carryover to or from the taxable year of a discharge of an amount for purposes for determining the amount allowable as a credit. Generally, if you owe a debt to someone else and they cancel or forgive that debt for less than its full amount, you are treated.

In General, If You Have Cancellation Of Debt Income Because Your Debt Is Canceled, Forgiven, Or Discharged For Less Than The Amount You Must.

Any carryover to or from the taxable year of a discharge of an amount for purposes for determining the amount allowable as a credit. Unfortunately, when you are relieved of debt through the cancellation of. Of course, the short answer is yes, this is taxable income. Generally, if you owe a debt to someone else and they cancel or forgive that debt for less than its full amount, you are treated for income tax.