Basis Differential - For the north american natural gas market, a basis price is typically the difference. Basis differential (or simply, basis) is most often traded by means of swaps. Basis differential is a factor that traders need to consider while hedging their commodity price. Basis differential represents the difference between the spot price of a commodity and the futures.

Basis differential represents the difference between the spot price of a commodity and the futures. Basis differential (or simply, basis) is most often traded by means of swaps. Basis differential is a factor that traders need to consider while hedging their commodity price. For the north american natural gas market, a basis price is typically the difference.

For the north american natural gas market, a basis price is typically the difference. Basis differential (or simply, basis) is most often traded by means of swaps. Basis differential represents the difference between the spot price of a commodity and the futures. Basis differential is a factor that traders need to consider while hedging their commodity price.

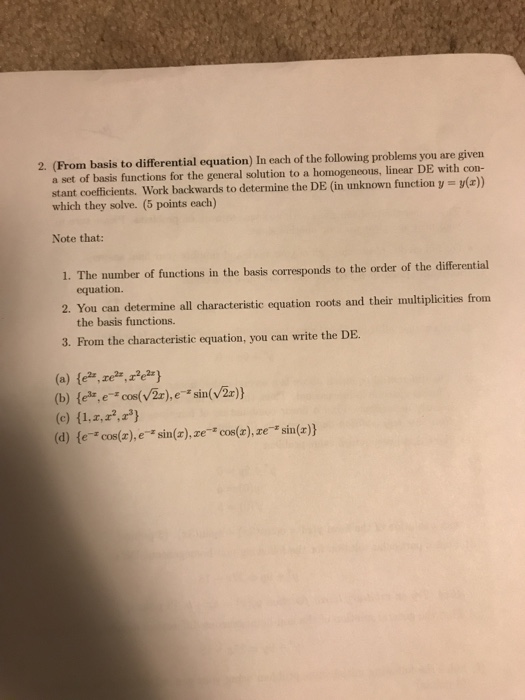

Solved 2. (From basis to differential equation) In each of

Basis differential represents the difference between the spot price of a commodity and the futures. Basis differential is a factor that traders need to consider while hedging their commodity price. Basis differential (or simply, basis) is most often traded by means of swaps. For the north american natural gas market, a basis price is typically the difference.

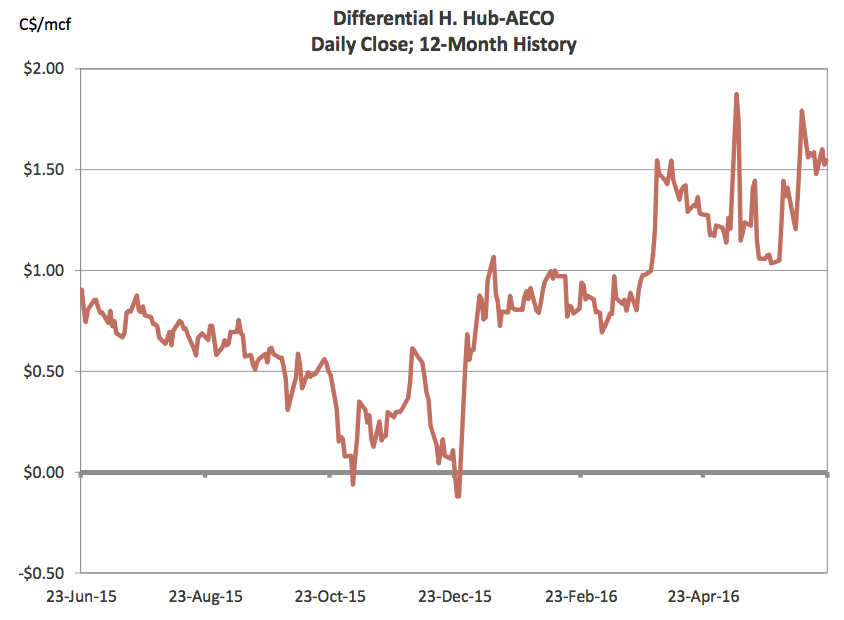

AECO Basis Differential Shrinks Natural Gas Daily (NYSEARCAUNG

Basis differential is a factor that traders need to consider while hedging their commodity price. Basis differential represents the difference between the spot price of a commodity and the futures. Basis differential (or simply, basis) is most often traded by means of swaps. For the north american natural gas market, a basis price is typically the difference.

Basis Differential AwesomeFinTech Blog

Basis differential is a factor that traders need to consider while hedging their commodity price. Basis differential represents the difference between the spot price of a commodity and the futures. Basis differential (or simply, basis) is most often traded by means of swaps. For the north american natural gas market, a basis price is typically the difference.

Solved From basis to differential equation) of basis

Basis differential (or simply, basis) is most often traded by means of swaps. Basis differential represents the difference between the spot price of a commodity and the futures. For the north american natural gas market, a basis price is typically the difference. Basis differential is a factor that traders need to consider while hedging their commodity price.

Standard Differential ProGear

Basis differential represents the difference between the spot price of a commodity and the futures. For the north american natural gas market, a basis price is typically the difference. Basis differential (or simply, basis) is most often traded by means of swaps. Basis differential is a factor that traders need to consider while hedging their commodity price.

Basis Differential AwesomeFinTech Blog

Basis differential (or simply, basis) is most often traded by means of swaps. Basis differential is a factor that traders need to consider while hedging their commodity price. Basis differential represents the difference between the spot price of a commodity and the futures. For the north american natural gas market, a basis price is typically the difference.

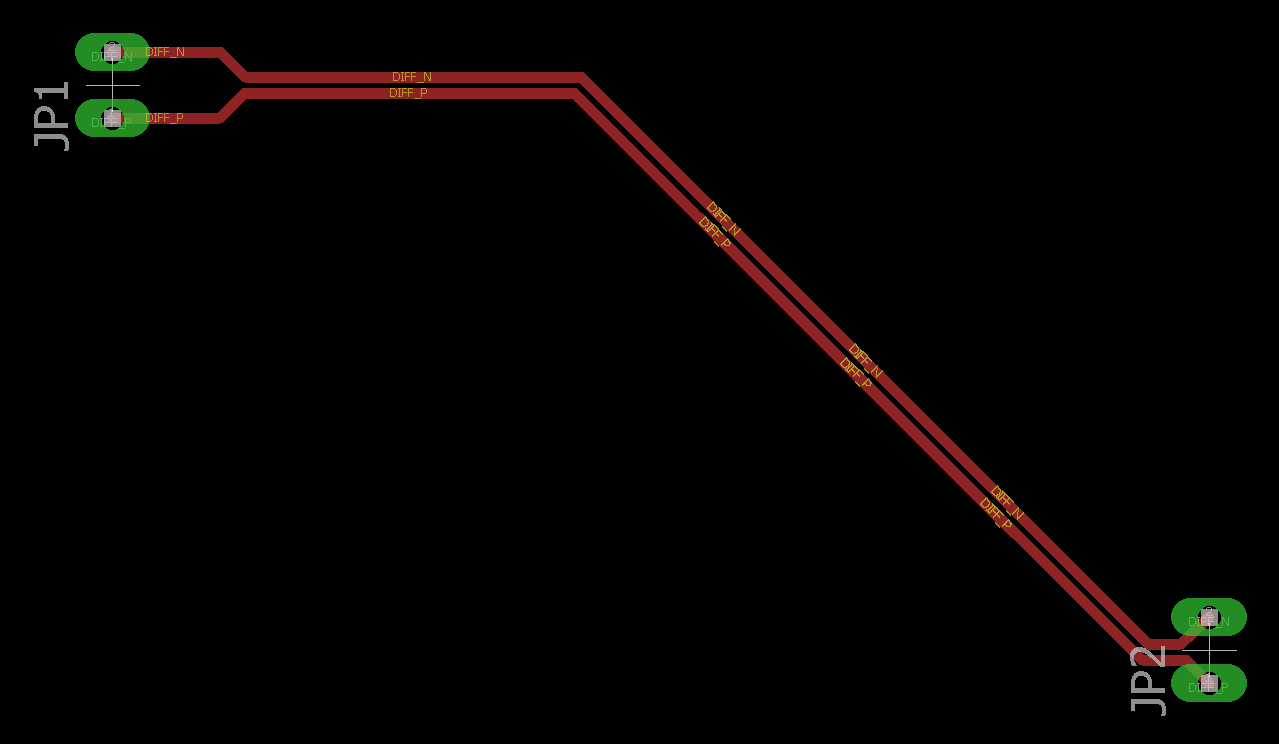

differentialpairs

Basis differential (or simply, basis) is most often traded by means of swaps. Basis differential is a factor that traders need to consider while hedging their commodity price. For the north american natural gas market, a basis price is typically the difference. Basis differential represents the difference between the spot price of a commodity and the futures.

Basis Differential AwesomeFinTech Blog

Basis differential is a factor that traders need to consider while hedging their commodity price. Basis differential (or simply, basis) is most often traded by means of swaps. For the north american natural gas market, a basis price is typically the difference. Basis differential represents the difference between the spot price of a commodity and the futures.

Solved 3. (From basis to differential equation) In each of

Basis differential represents the difference between the spot price of a commodity and the futures. Basis differential (or simply, basis) is most often traded by means of swaps. Basis differential is a factor that traders need to consider while hedging their commodity price. For the north american natural gas market, a basis price is typically the difference.

Solved From basis to differential equation) of basis

Basis differential is a factor that traders need to consider while hedging their commodity price. For the north american natural gas market, a basis price is typically the difference. Basis differential represents the difference between the spot price of a commodity and the futures. Basis differential (or simply, basis) is most often traded by means of swaps.

Basis Differential Represents The Difference Between The Spot Price Of A Commodity And The Futures.

For the north american natural gas market, a basis price is typically the difference. Basis differential is a factor that traders need to consider while hedging their commodity price. Basis differential (or simply, basis) is most often traded by means of swaps.