Arkansas State Income Tax Form - Arkansas participates in the federal/state electronic filing program for individual income. 26 rows arkansas has a state income tax that ranges between 2% and 4.4%, which is. Use this table along with your arkansas agi to determine your allowable deduction.

Arkansas participates in the federal/state electronic filing program for individual income. Use this table along with your arkansas agi to determine your allowable deduction. 26 rows arkansas has a state income tax that ranges between 2% and 4.4%, which is.

Arkansas participates in the federal/state electronic filing program for individual income. 26 rows arkansas has a state income tax that ranges between 2% and 4.4%, which is. Use this table along with your arkansas agi to determine your allowable deduction.

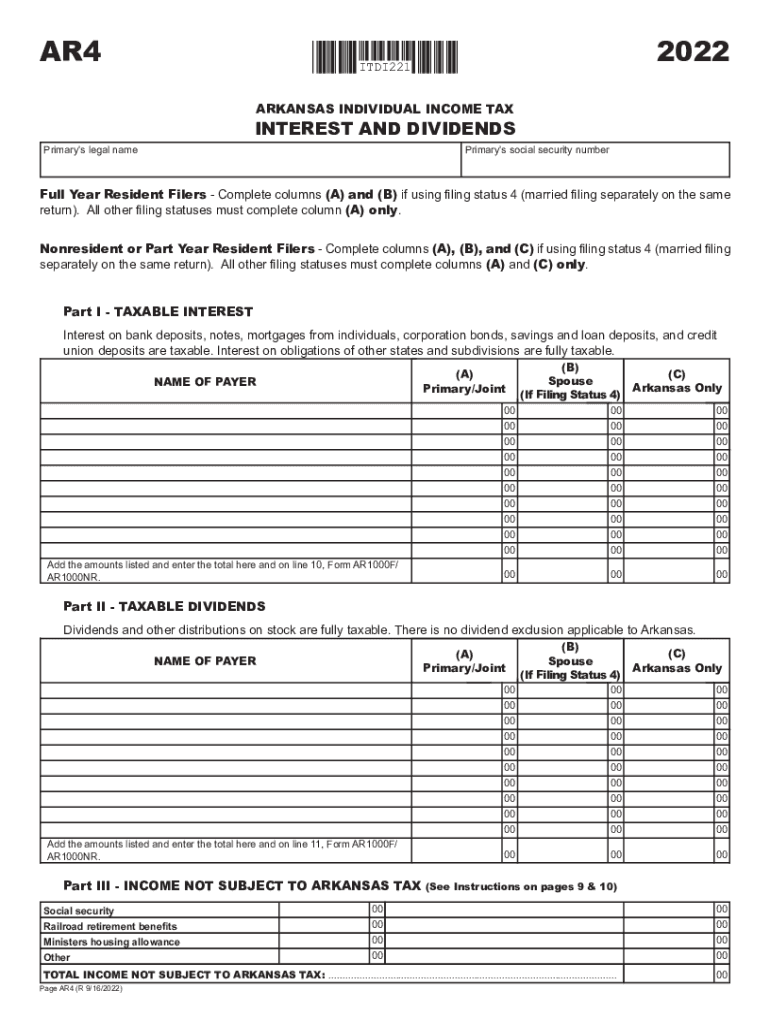

Ar4 20222024 Form Fill Out and Sign Printable PDF Template

Use this table along with your arkansas agi to determine your allowable deduction. Arkansas participates in the federal/state electronic filing program for individual income. 26 rows arkansas has a state income tax that ranges between 2% and 4.4%, which is.

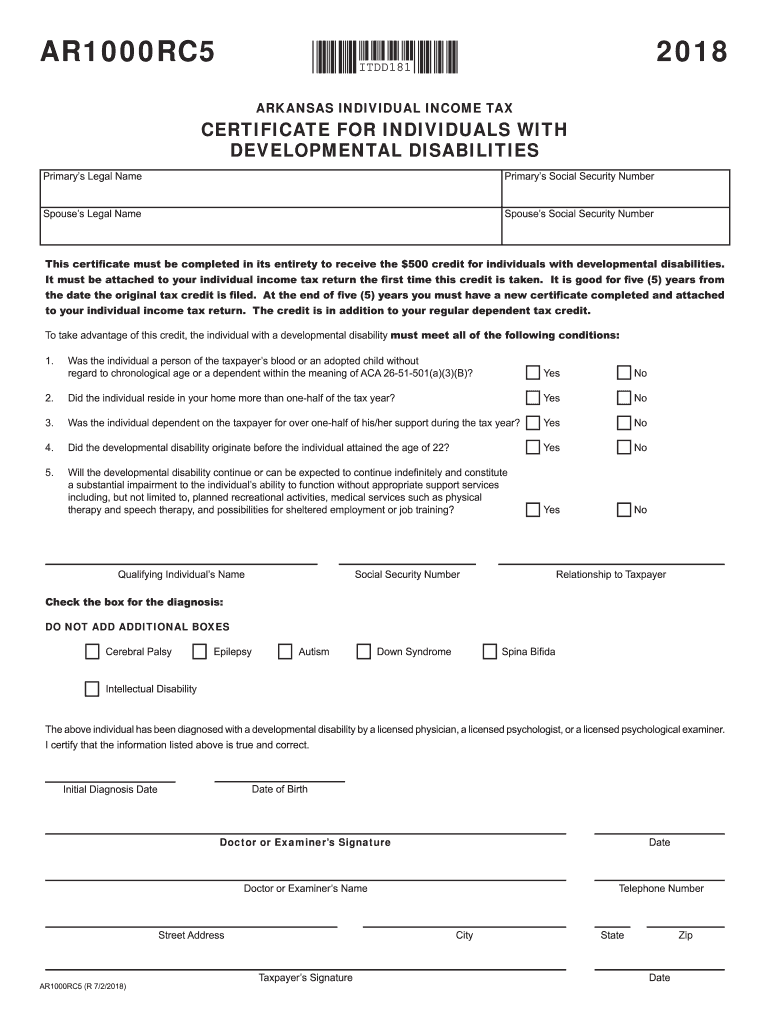

Ar1000rc5 Arkansas 20182024 Form Fill Out and Sign Printable PDF

Use this table along with your arkansas agi to determine your allowable deduction. Arkansas participates in the federal/state electronic filing program for individual income. 26 rows arkansas has a state income tax that ranges between 2% and 4.4%, which is.

Your Ultimate Checklist for eFiling Arkansas State Tax

Use this table along with your arkansas agi to determine your allowable deduction. 26 rows arkansas has a state income tax that ranges between 2% and 4.4%, which is. Arkansas participates in the federal/state electronic filing program for individual income.

Arkansas Individual Tax 2024 2025

26 rows arkansas has a state income tax that ranges between 2% and 4.4%, which is. Arkansas participates in the federal/state electronic filing program for individual income. Use this table along with your arkansas agi to determine your allowable deduction.

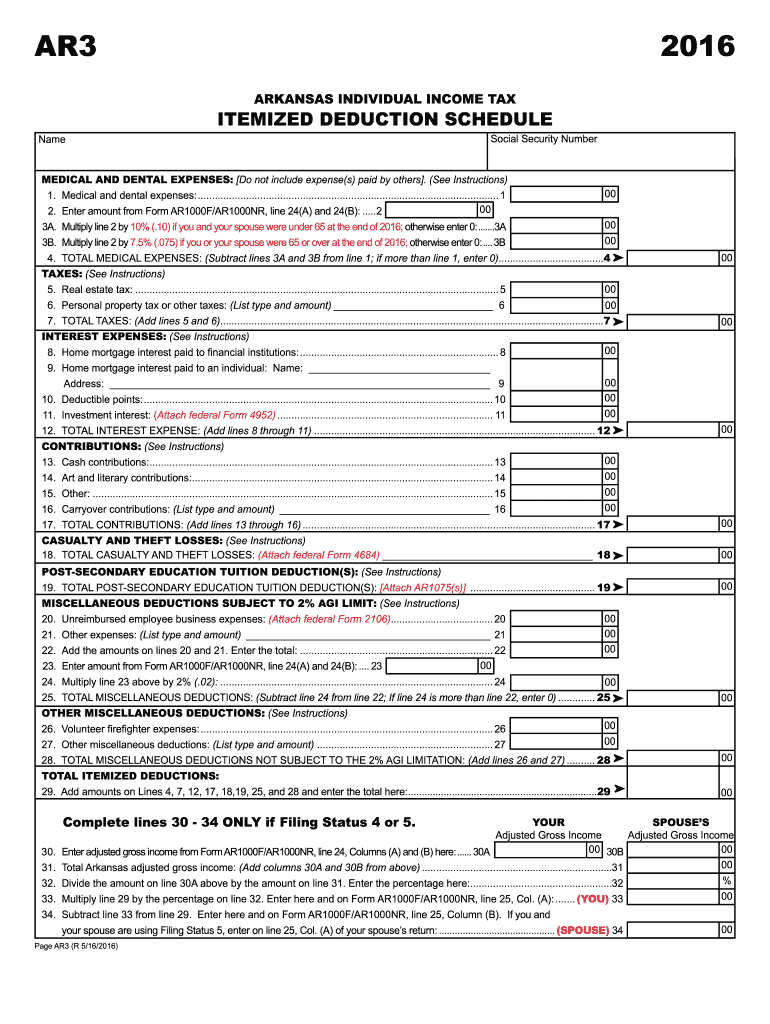

Arkansas state tax form ar3 Fill out & sign online DocHub

Use this table along with your arkansas agi to determine your allowable deduction. Arkansas participates in the federal/state electronic filing program for individual income. 26 rows arkansas has a state income tax that ranges between 2% and 4.4%, which is.

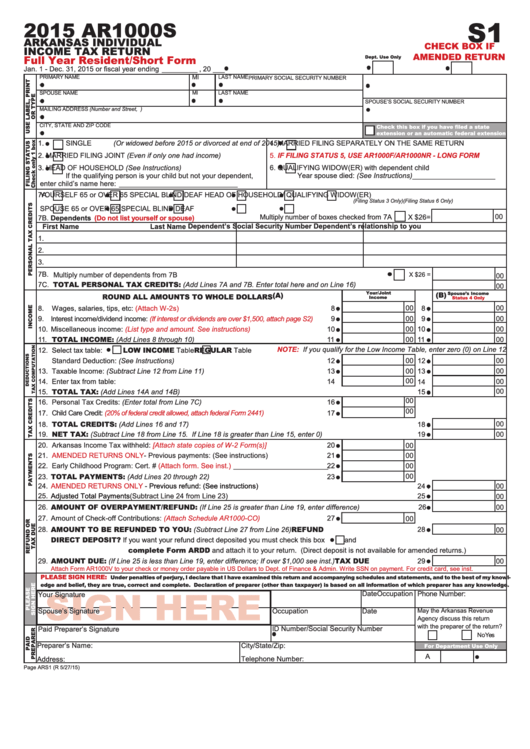

Form Ar1000s Arkansas Individual Tax Return 2015 printable

Use this table along with your arkansas agi to determine your allowable deduction. 26 rows arkansas has a state income tax that ranges between 2% and 4.4%, which is. Arkansas participates in the federal/state electronic filing program for individual income.

Printable Arkansas State Tax Forms Printable Forms Free Online

Arkansas participates in the federal/state electronic filing program for individual income. 26 rows arkansas has a state income tax that ranges between 2% and 4.4%, which is. Use this table along with your arkansas agi to determine your allowable deduction.

Arkansas State Tax Exemptions

Arkansas participates in the federal/state electronic filing program for individual income. Use this table along with your arkansas agi to determine your allowable deduction. 26 rows arkansas has a state income tax that ranges between 2% and 4.4%, which is.

Arkansas State Tax

26 rows arkansas has a state income tax that ranges between 2% and 4.4%, which is. Use this table along with your arkansas agi to determine your allowable deduction. Arkansas participates in the federal/state electronic filing program for individual income.

Free Printable Arkansas Tax Form Ar1000s Printable Forms Free

Arkansas participates in the federal/state electronic filing program for individual income. Use this table along with your arkansas agi to determine your allowable deduction. 26 rows arkansas has a state income tax that ranges between 2% and 4.4%, which is.

Use This Table Along With Your Arkansas Agi To Determine Your Allowable Deduction.

26 rows arkansas has a state income tax that ranges between 2% and 4.4%, which is. Arkansas participates in the federal/state electronic filing program for individual income.